Pleo x Lucinity

Challenge

The need to effectively and scalably combat money laundering

Pleo's significant growth led to a notable increase in the volume of transactions managed, exceeding €1 billion in 2020. The company's existing in-house system for monitoring transactions had reached its peak effectiveness, presenting a critical challenge. This realization sparked the search for a provider capable of being more than just a vendor; Pleo sought a partner with the expertise to understand its unique operational context and customer base. Due to this complexity, Pleo required a partner that could investigate specific behaviors and scenarios, thereby enhancing its ability to effectively combat financial crimes.

Pleo aimed to implement a system to identify unusual transaction patterns with greater accuracy and efficiency. The goal was to significantly reduce its false positive rate—a common issue for many financial institutions—which often leads to wasted resources and potential oversight of genuine threats. By collaborating with a provider capable of delivering more meaningful alert assessments, Pleo sought to streamline its processes, allowing it to focus on investigating and addressing the most substantial risks.

Decision to Partner with Lucinity

Not just a vendor, also a partner

After an extensive evaluation of over 30 vendors, Pleo selected Lucinity as the best solution to meet its compliance needs. Among the various vendors considered, Lucinity distinguished itself significantly during the evaluation phase. Pleo sent the same dataset to all shortlisted providers to assess their ability to identify suspicious activities. Lucinity's response was unique, uncovering unexpected patterns and connections within the data that had previously gone unnoticed by Pleo and other vendors.

Pleo partnered with Lucinity to achieve its strategic objectives of scaling its business and enhancing operational efficiency. Lucinity’s solution complemented Pleo's expansion, accommodating more customers and handling an increasing volume of transactions without proportionally expanding its workforce. Furthermore, Lucinity could help Pleo enhance decision-making, accountability, and overall job satisfaction for analysts.

Solution

End-to-end FinCrime Investigation

Five team members from Pleo use Lucinity's software on a daily basis. Lucinity was implemented at Pleo in a phased approach, starting with card transactions and expanding to other products.

Utilizing Lucinity's Actor Intelligence module, Pleo gains a comprehensive overview of its customers, enabling a deeper understanding of their behaviors and associated risks. By consolidating all necessary information into a unified platform, analysts are able to quickly understand each customer's profile and spot anomalies.

Lucinity's Case Manager and Workboard provide an innovative way to review and investigate suspicious cases, moving away from siloed systems to a more holistic and detailed analysis. With Lucinity, Pleo is also able to streamline workflows and automate manual tasks, saving time and costs.

Some of the Pleo team's favorite features include being able to connect multiple cases to one actor, seeing all the relevant transactions relating to that actor, and having the audit log that tracks changes to a case over time. Lucinity has helped Pleo move towards a risk-based approach, minimizing irrelevant alerts and concentrating efforts on true suspicious activity.

The Lucinity Platform

Automate compliance workflows

Gain thousands of hours back with Generative AI

Accelerate investigations

Dive deeper with consistent, thorough, and fully auditable investigations

Simplify with SaaS

Minimize implementation and maintenance costs

Implementation Process

A highly collaborative approach between Lucinity and Pleo

During the process, Lucinity provided a highly collaborative experience that facilitated successful product implementation and adoption.

- Process Mapping and Requirements Gathering: Lucinity invited relevant stakeholders from Pleo to an in-person workshop in Iceland to map out current and desired processes, gather compliance requirements, and gain insight into Pleo's pain points, technical nuances, and integration requirements.

- Project Team Norms: Throughout implementation and training, Pleo and Lucinity worked together in a highly collaborative manner, with shared missions, open communication, collaboration, and agility being critical success factors. Both teams demonstrated a high level of empathy and created a psychologically safe space for concerns to be raised.

- Sustainment: Lucinity continues to offer ongoing support to Pleo's team, addressing any issues that may arise and offering regular maintenance and updates to the software, which continues to evolve as more features are added, enabling the Pleo team to achieve even greater efficiencies.

Working with the Lucinity Team

Highly collaborative partnership

From the outset, Lucinity's approach of kindness, willingness to adapt, and openness to learning alongside Pleo has been crucial. This adaptable and cooperative mindset has been particularly valuable to Pleo, a company that prides itself on innovation and agility. Working with Lucinity has allowed Pleo to experiment, learn, and configure solutions to meet its unique requirements.

Moreover, Pleo highlights Lucinity's compassionate and customer-centric approach. Feeling valued and taken seriously, Pleo has found a partner in Lucinity that not only listens to its challenges but also actively seeks solutions to address them. The ability to configure the Lucinity product to meet Pleo’s tailored requirements is an important aspect of their partnership, demonstrating the depth of collaboration between Pleo and Lucinity.

Q&A with Pleo

Behind the Scenes with Hannah Becher: A Conversation on FinCrime Investigation Processes

Get firsthand insights from Hannah Becher herself! In this Q&A document, Lucinity engages in a candid conversation with Hannah Becher, Fraud and Transaction Surveillance Lead at Pleo, shedding light on her experiences using the Lucinity platform and collaborating with the Lucinity team. Download the document to gain deeper insights into this enlightening discussion.

"Since integrating Lucinity, we've transformed our compliance workload, focusing our team on what really matters. The relevance ratio improvement is not just a metric for us; it's a day-to-day reality that has significantly enhanced our operational efficiency."

Results

Less noise, more relevant investigations

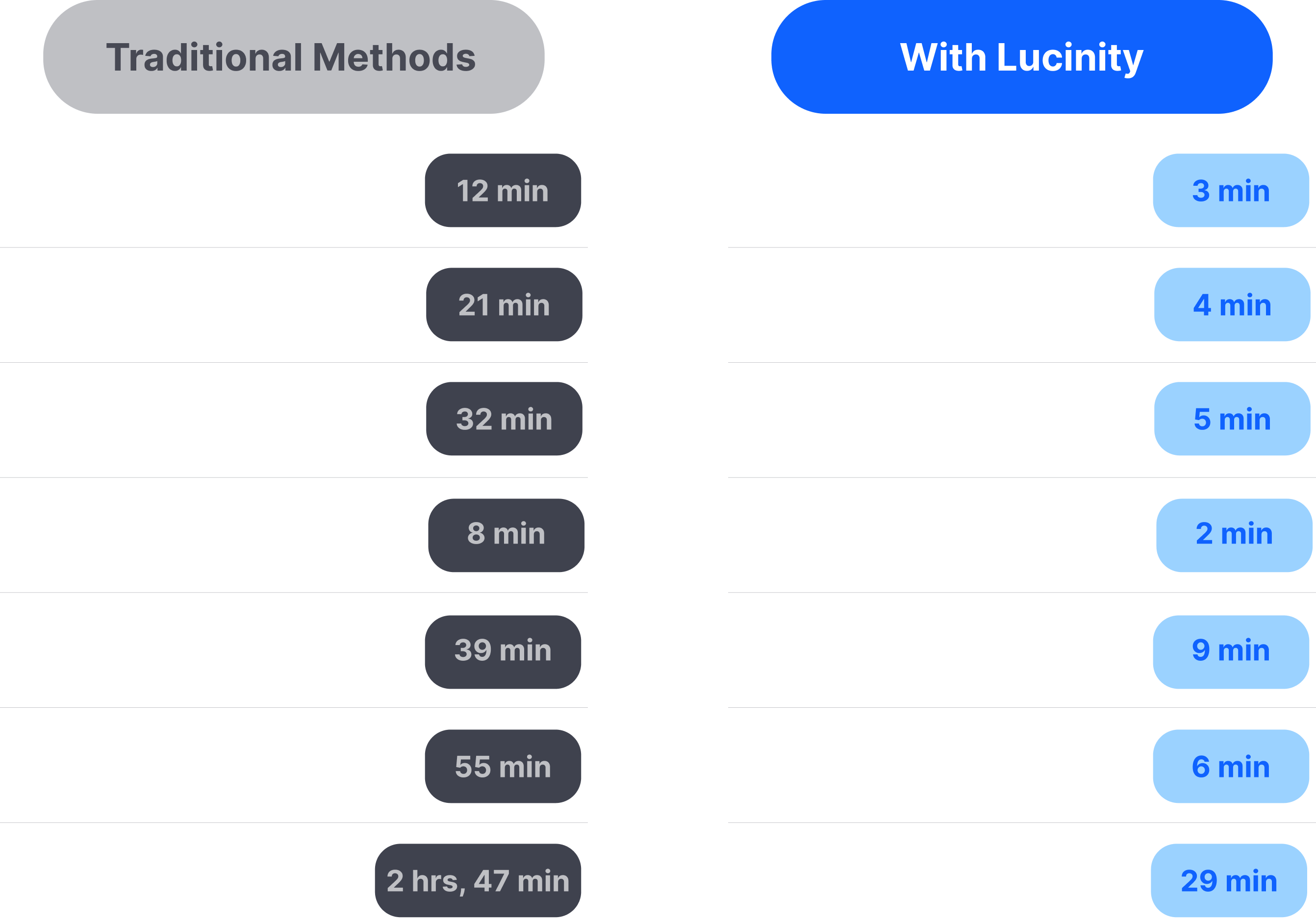

Since adopting Lucinity, Pleo has significantly improved its transaction monitoring and financial crime detection, moving from a high false positive rate to a more efficient system. Pleo reports that with Lucinity's assistance, its relevance ratio has increased, indicating a higher proportion of cases advancing to level 2 investigations. This improvement means the majority of alerts received by the compliance team are now more meaningful, reducing analysts' alert fatigue and better prioritizing their time and attention.

Lucinity has also transformed Pleo's investigative process, especially for in-depth level-two investigations. By centralizing critical data, Lucinity's Case Manager simplifies and speeds up the analysis, enabling quicker, more informed decisions.

Next Steps

Generative AI with the Luci Copilot

Pleo is embracing the potential that Generative AI, specifically Lucinity's Luci copilot, holds for enhancing its financial crime investigation processes. The vast amounts of data involved in monitoring transactions, customer profiles, and behavioral patterns pose a significant challenge for human analysts, who may not always be able to derive meaningful insights efficiently from such complex datasets. Luci assists in analyzing customer data, explaining suspicious behaviors, writing coherent narratives, automating tasks, and upskilling analysts.

By simulating the human decision-making process, Luci can alleviate the cognitive load on analysts, who are often inundated with alerts and the monotonous aspects of investigations. With Luci, analysts will be able to focus on the critical aspects of their work—evaluating the legitimacy of transactions and identifying risks—by automating the aggregation and preliminary analysis of data.

About Pleo

A Unicorn FinTech Company disrupting the expense management industry

Pleo, a leading innovator in the fintech space, specializes in streamlining business expenses and financial management for companies across Europe. Valued at $4.7 billion after its latest funding round, Pleo has raised over $400 million to date, reflecting strong investor confidence and its robust growth potential. With a dedicated team of over 800 employees, Pleo is committed to transforming how businesses handle spending through its smart payment cards and comprehensive software solutions.

These tools offer real-time spending visibility, automate reporting processes, and empower employees with the autonomy to make purchases, all while ensuring financial controls are in place. Pleo's mission is to eliminate the complexity of financial management, enabling companies to focus on their core activities. Headquartered in Copenhagen, Pleo serves thousands of businesses, demonstrating its significant impact on improving operational efficiencies and financial decision-making in the digital age.