Filing made easy—fast, compliant, and stress-free

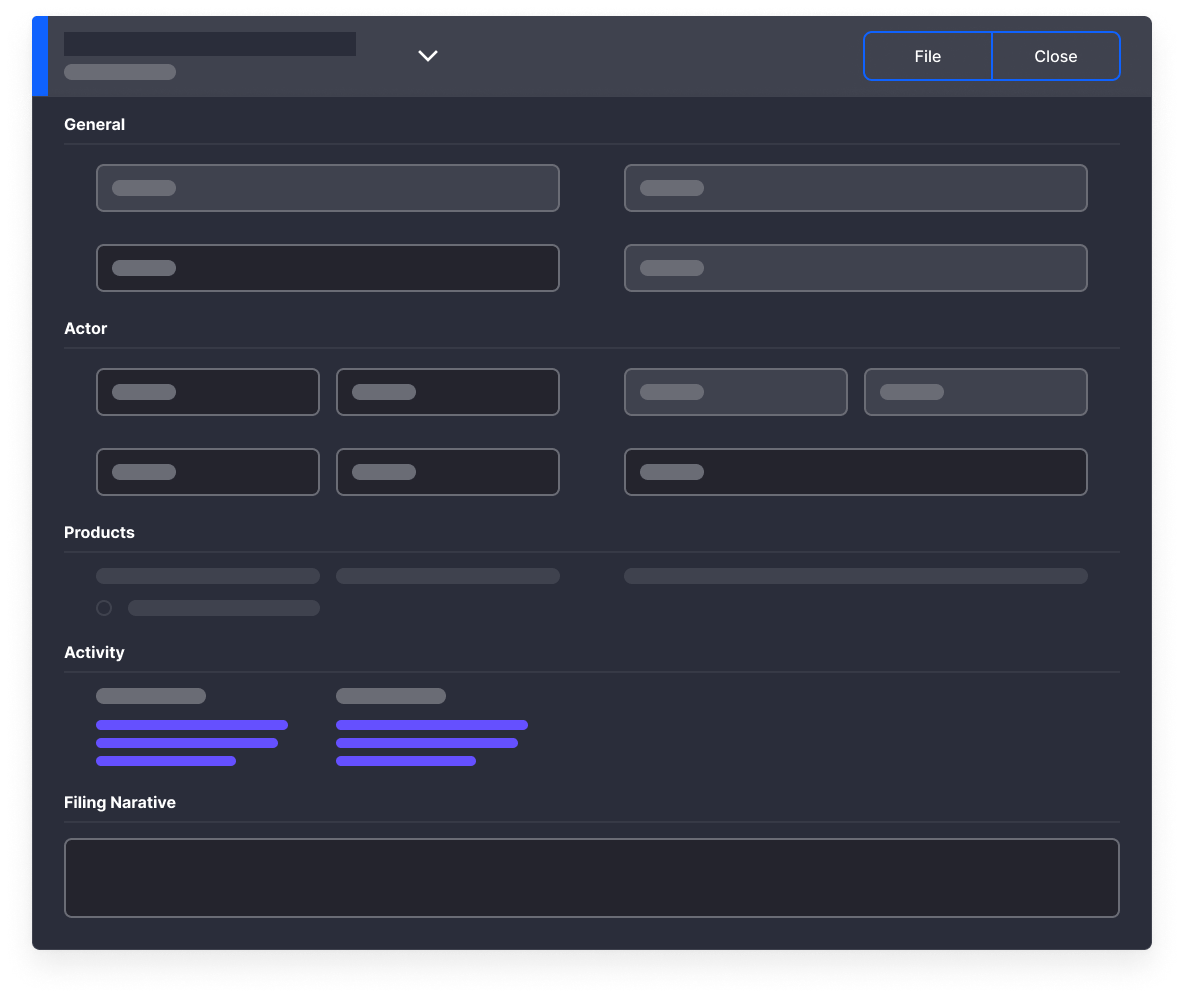

- Versatile Reporting Choices: Create diverse reports such as Suspicious Activity Reports (SARs), Currency Transaction Reports (CTRs), and more.

- Straight Through Filing: Connect directly to FinCEN, NCA, and some GoAML jurisdictions using our API, and manage submissions, responses, and status changes.

- Manual Filing: When regulators don't offer API integrations, generate pre-formatted XMLs and export directly from our platform for submissions.

Submit directly to regulators across any jurisdiction

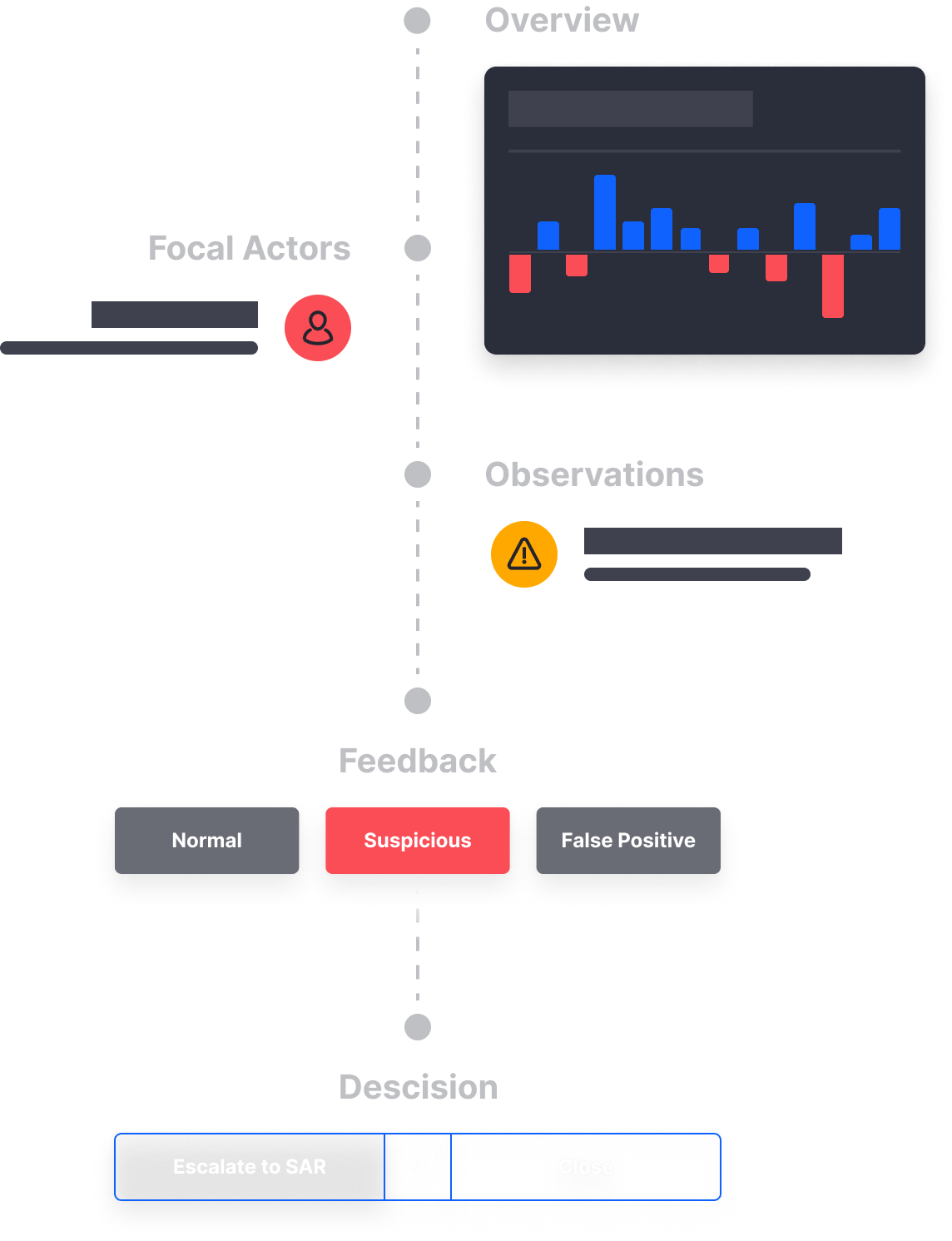

- Seamless Detection to Submission: Smoothly transition from detection to regulatory submission. Enhance consistency, reduce errors, and gain complete traceability of each case.

- Flexible Integration: Use Lucinity's Regulatory Reporting as an extension or standalone feature. Our platform flexibly adapts to your needs.

- Tailored for Every Jurisdiction: Adjust reporting to meet jurisdictional requirements. Ensure accurate, consistent, and tailored submissions to meet specific regulatory standards.

Integrated into Lucinity's Case Manager

Lucinity’s regulatory reporting is seamlessly embedded within our Case Manager, giving you a unified system to investigate, document, and file—all in one place. By connecting with your company’s systems, Case Manager automatically pulls in relevant data, ensuring reports are accurate and complete without manual effort. Luci AI handles the heavy lifting by drafting filings for you, dramatically reducing time spent on paperwork.