Luci will be a game-changer for us. Its ability to transform complex AI findings into actionable insights will empower our team to make faster, more informed decisions, saving valuable time and resources in our fight against financial crime.

Build Skills with the Luci Studio

Use pre-built Luci Skills (Negative News, Deep Search, etc.) or build your own to automate use cases and configure Luci to your business needs.

Luci Studio, a no-code, drag and drop interface, gives you maximum configurability and control where you can connect to APIs, choose your data sources, and control Luci's output.

Examples of Luci Skills

Case Summarization

Luci summarizes cases, offering insights and highlighting risk indicators. Case summaries come in customizable, standardized formats.

Business Validation

Validates business legitimacy by cross-referencing declared information with online presence and official records.

Adverse Media and Negative News Searches

Conducts detailed searches and analyzes for red flags in selected sources, connects to third-party adverse media and negative news providers, and offers summarized recommendations.

Luci Explain

Answers inquiries about internal business processes and policies to ensure team consistency and facilitate training.

Money Flow Visualization

Provides visual representations of customer transaction flows, highlighting incoming and outgoing transactions.

Transaction Summary

Offers instant transactional insights and visual statistics, directly integrating with transaction sources and simplifying data analysis.

Writing and Sending RFIs

Manages and standardizes the creation and dispatch of RFIs, maintaining communication history in one place.

Generate SAR/Case Narratives

Easily generates editable SAR/Case narratives, tailored to include specific data and in a standardized format.

Address Check

Checks business addresses to aid in validating the legitimacy of businesses.

A Lucinity Lab Case Study

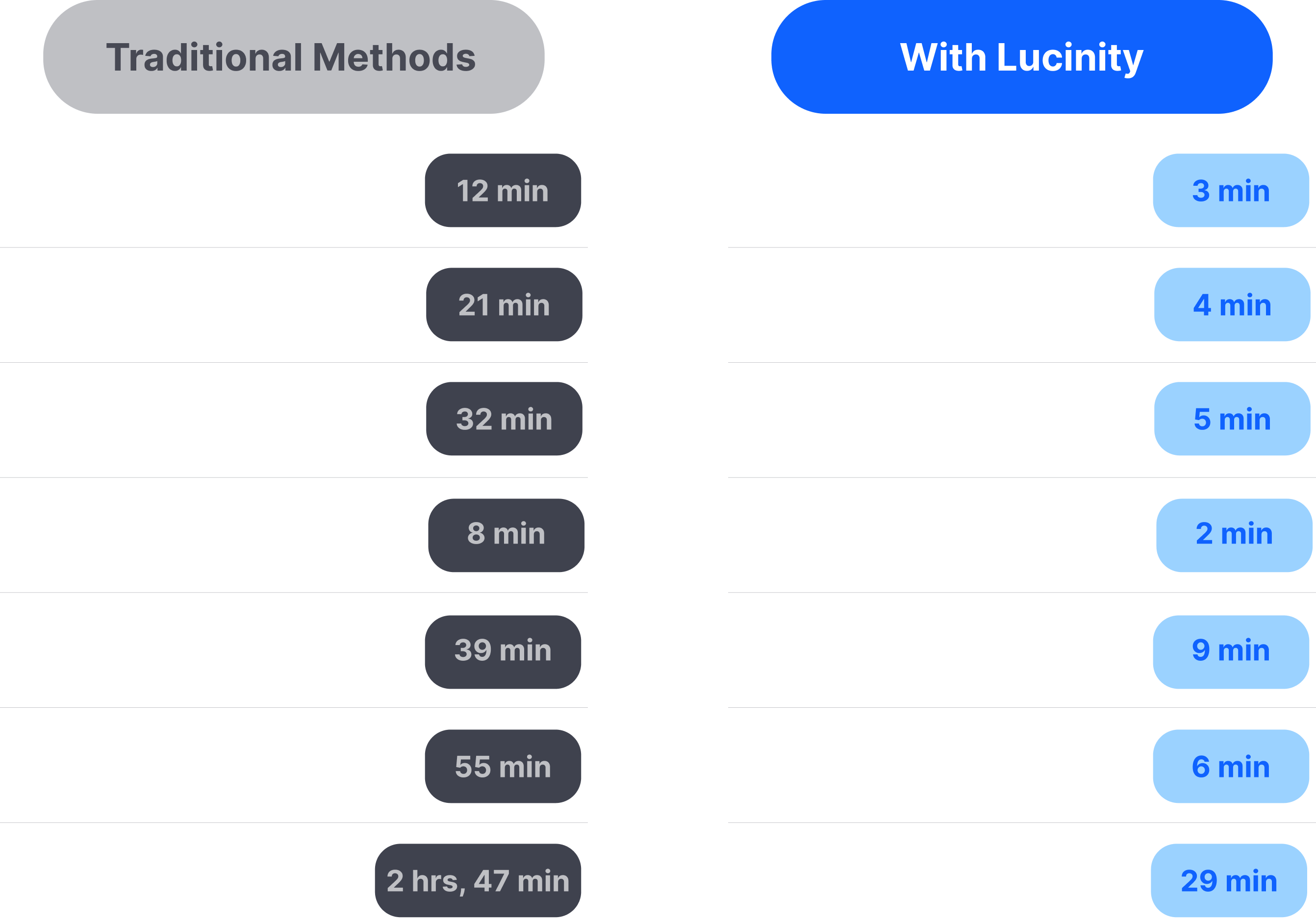

With Luci, Time is on Your Side

Integrating Luci can dramatically reduce investigation times from hours to minutes. Luci streamlines every step, from initial case assessment to the final documentation, accelerating your FinCrime prevention efforts.

Ensuring Security, Scalability, and Privacy with Luci

In this blog, Lucinity's technology team shares the measures taken to ensure the security of Luci, our AI agent for financial services. It highlights our use of Azure and Azure OpenAI for creating a secure, scalable, and privacy-focused infrastructure

See it in Action

Want to try out the Luci AI Plugin? Speak with our team to see it in action.

FAQs about Luci

Luci offers instant value with zero initial integration for out-of-the-box skills such as public source searches and narrative writing, providing immediate benefits.

Yes, Luci is configurable. The Luci Studio is self-service, allowing you to tailor Luci's skills to your specific requirements, specifying and ranking various data sources. You can also create end-to-end workflows incorporating automation and AI.

Luci is now available as a Chrome or Edge extension for easy deployment. It can also be deployed as a Software Development Kit (SDK), enabling integration into enterprise applications without the need for a browser extension, ensuring it is always positioned correctly within your systems.

Yes, Luci has been tested and works with other languages and alphabets, making it versatile for global use.

No, Luci does not make decisions. It provides analysis and recommendations, but the user ultimately decides how to action the case. The user can also edit any of the recommendations shared by Luci when adding notes to the case.

Originating in financial crime prevention, the most secure and rigorous part of banking, Luci has been designed with security in mind from the start. Lucinity offers clear guidelines on responsible AI use, reflecting our commitment to ethical practices. Our platform is designed for human oversight, ensuring transparency and control from start to finish.

Lucinity uses state-of-the-art models like Microsoft Azure Open AI for secure infrastructure. Data is processed within a secure Azure-hosted instance and is not used for training purposes outside of it. The base Luci Plugin does not store data, but an upgrade option offers audit logs and case management with top-tier security.

Yes, all of Luci's actions are explainable and evidence-based. The Luci Studio provides transparent processes, and the Audit Log Access Panel allows easy CSV export for regulators.

In the audit log, Luci captures and distinguishes between actions taken by the system and those taken by the user, ensuring clear tracking and accountability.

Luci mitigates the risk of hallucinations by employing explainable AI and evidenced recommendation-making processes. Additionally, Luci is designed to provide recommendations based strictly on the data provided, ensuring it remains grounded in factual information.

Luci can connect to various data sources specified by the user. The control over these sources is managed through the Luci Studio and API integrations, allowing you to utilize existing licenses and data sources effectively.

Want Even More Luci?

Explore our complete AI powered platform

While the plug-in can enhance any existing system, Luci also powers the full Lucinity suite, including Case Manager and Customer 360.

Built on Trust

Luci's foundation in financial crime prevention ensures it meets the highest standards of security and auditability, making it a trusted tool in one of the most secure and rigorously monitored areas within banking.

Committed to Responsible AI Innovation

At Lucinity, we believe in the power of AI to build a better world. Guided by our Ethical AI Pledge, Luci is a testament to our unwavering commitment to responsible AI development.