Guides & Downloads

7 Compliance and FinCrime Trends for 2026

Financial crime compliance is facing higher expectations with little room for inefficiency. This guide outlines the shifts that will shape how teams operate in the coming years, including the move toward managed services, AI becoming part of everyday investigation and triage work, tighter and more coordinated regulation, increased data sharing between institutions, a stronger focus on sanctions and corruption risk, case management evolving into a core compliance control, and a growing emphasis on designing compliance processes that reduce friction without weakening oversight.

Lucinity's Guide to Effective Transaction Monitoring

This guide offers a practical, detailed walkthrough of Lucinity’s approach to modern transaction monitoring. It covers how to build, test, and fine-tune detection scenarios without relying on developers; how to use segmentation to tailor monitoring to different customer types; and how to reduce false positives using tools like the Time Machine for historical backtesting.

Lucinity and Finshark Case Study

Discover how Finshark scaled its open banking operations with Lucinity’s AI-powered FinCrime operating system. This case study explores how Finshark replaced its fragmented setup with a streamlined, automated workflow—boosting investigation consistency, traceability, and scalability. Learn how Lucinity’s flexible, AI-driven platform reduced manual work, empowered analysts and developers, and was configured to Finshark’s business processes.

7 Compliance & FinCrime Trends for 2025

From Manual Reviews to Actionable Intelligence

Explore the top seven trends in AI-driven financial crime compliance for 2025. This report covers key advancements, including AI automation in compliance, real-time transaction monitoring to reduce false positives, and federated learning for secure risk detection. Learn how large transaction models (LTMs) are enhancing fraud detection and why compliance teams are shifting from manual reviews to AI-powered investigations. Download now to see how AI and automation are transforming financial crime prevention.

Luci Safety, Accuracy, & Trustworthiness

How has the Luci AI Copilot been created with optimal security

Without proper safeguards, AI can introduce more risks than it mitigates, making explainability and security essential for auditors and regulators. Luci, Lucinity’s AI Agent, addresses these challenges by leveraging Retrieval-Augmented Generation (RAG) to ground outputs in real-time data, combined with rigorous testing and validation for accuracy and reliability. Download our guide to learn how you can implement AI in compliance securely and with confidence.

Top 6 Upcoming AI Innovations in Financial Services

Lucinity's Predictions on the next wave of AI developments

While many companies are scrambling to catch up with current AI innovations, the real advantage lies in thinking ahead. Lucinity’s report, Top 6 Upcoming AI Innovations in Financial Services, reveals our prediction on the next wave of AI developments that will reshape how financial institutions manage risk, improve compliance, and enhance customer experience. The trends discussed include enhanced AI reasoning capabilities, the next-generation of GPT models, improved data retrieval systems, and more.

2024 Forecast: Overview of Core FinCrime Risk Principles

1LoD and Lucinity Post-Event Report

Published by 1LoD and sponsored by Lucinity, this report emphasizes the cautious adoption of AI and machine learning to enhance financial crime management while retaining human intuition for complex cases. It advocates for a proactive approach through scenario planning and robust data governance to build an effective risk management foundation. The report highlights the importance of harmonizing regional and global regulations.

2024 AI Forecast: Evolving Non-Financial Risk Across 3 Lines of Defense

xLoD Global and Lucinity Post-Event Report

Published by xLoD Global and sponsored by Lucinity, this report urges businesses to adopt a holistic, agile approach to non-financial risk management, integrating it into core operations to tackle global crises and geopolitical disruptions. It highlights the crucial role of CEOs and C-suite executives in fostering a culture of shared responsibility and open communication.

Seven Compliance and FinCrime Trends for 2024

Generative AI, Industrialization of Fraud, Organized Crime Groups, Sanctions, and more

As financial institutions prepare for 2024, Lucinity highlights seven pivotal trends that are reshaping the industry. With rapid technological evolution and complex geopolitical shifts, the risk landscape for financial crime is becoming increasingly intricate. This report provides an in-depth analysis of emerging threats and suggests innovative strategies required for effective FinCrime prevention.

Infographic: Seven Compliance and FinCrime Trends for 2024

Preparing for the Future of Financial Crime Prevention

This infographic on Compliance and FinCrime Trends for 2024 succinctly outlines seven key developments in the industry. It emphasizes the rise of generative AI, AML and sanctions convergence, and the industrialization of fraud. Additionally, it points out stricter financial crime regulation, cyber-enabled economic crime, and the rise of economic crime groups (OCGs). This compact yet comprehensive visual guide offers essential insights for FinCrime prevention professionals.

Infographic: The Role of Public - Private Partnerships

Collaborating Across Sectors to Strengthen Financial Crime Prevention

Public-Private Partnerships (PPPs) bring together governments, regulators, and private entities to address financial crime more effectively. This infographic outlines how these collaborations improve intelligence sharing, enable the use of advanced technologies, and support global cooperation. With examples such as AUSTRAC’s Fintel Alliance and the UK’s JMLIT, it demonstrates how PPPs contribute to stronger compliance efforts, better resource use, and improved approaches to tackling financial crime.

Infographic: Generative AI Copilots

Taking FinCrime Investigations from Hours to Minutes

Generative AI copilots are transforming FinCrime investigations by automating repetitive tasks, reducing human error, and providing actionable insights. They streamline compliance processes, enhance decision-making through predictive analytics, and improve cost efficiency. With faster operations and increased transparency enabled by explainable AI, these tools empower financial institutions to manage risks more effectively and proactively.

Infographic: Top 6 Regulatory Fines

Lessons in Risk, Compliance, and Accountability

The most significant regulatory fines across industries provide a stark reminder of the critical need for strong compliance frameworks and ethical business practices. This infographic highlights landmark cases, including multi-billion-dollar fines, and their profound impact on reshaping global compliance standards. From failures in AML oversight to breaches in customer due diligence, these cases underscore the value of proactive risk management and adherence to regulations. Let these lessons guide organizations toward building robust governance structures and avoiding costly mistakes.

Infographic: 3 Lines of Defense

A Structured Framework for Risk Management

This infographic explores the Three Lines of Defense model, a key compliance framework that defines roles across operational management, risk oversight, and audit. It highlights the model's evolution through enhanced collaboration, technology integration, and adaptability while addressing challenges like communication gaps and regulatory changes. A concise guide for strengthening governance and mitigating risks effectively.

Infographic: GenAI Transforming Case Management

Enhancing Efficiency in Compliance and Decision-Making

This infographic highlights how AI copilots improve case management by automating tasks, ensuring regulatory compliance, and providing actionable insights. These tools simplify complex data into clear summaries, streamline operations across industries, and integrate seamlessly with existing systems. With robust security features and cost-saving benefits, AI copilots support smarter decision-making and more effective compliance efforts.

Infographic: A Guide to Trade Sanctions

Balancing Diplomacy and Financial Risk

This infographic explores trade sanctions as a critical tool in international relations, blending diplomacy with economic leverage. They target violations of international norms while offering an alternative to military action. However, their implementation requires careful navigation of global complexities. This infographic delves into the essence of trade sanctions, highlighting their types, global impacts, and notable examples.

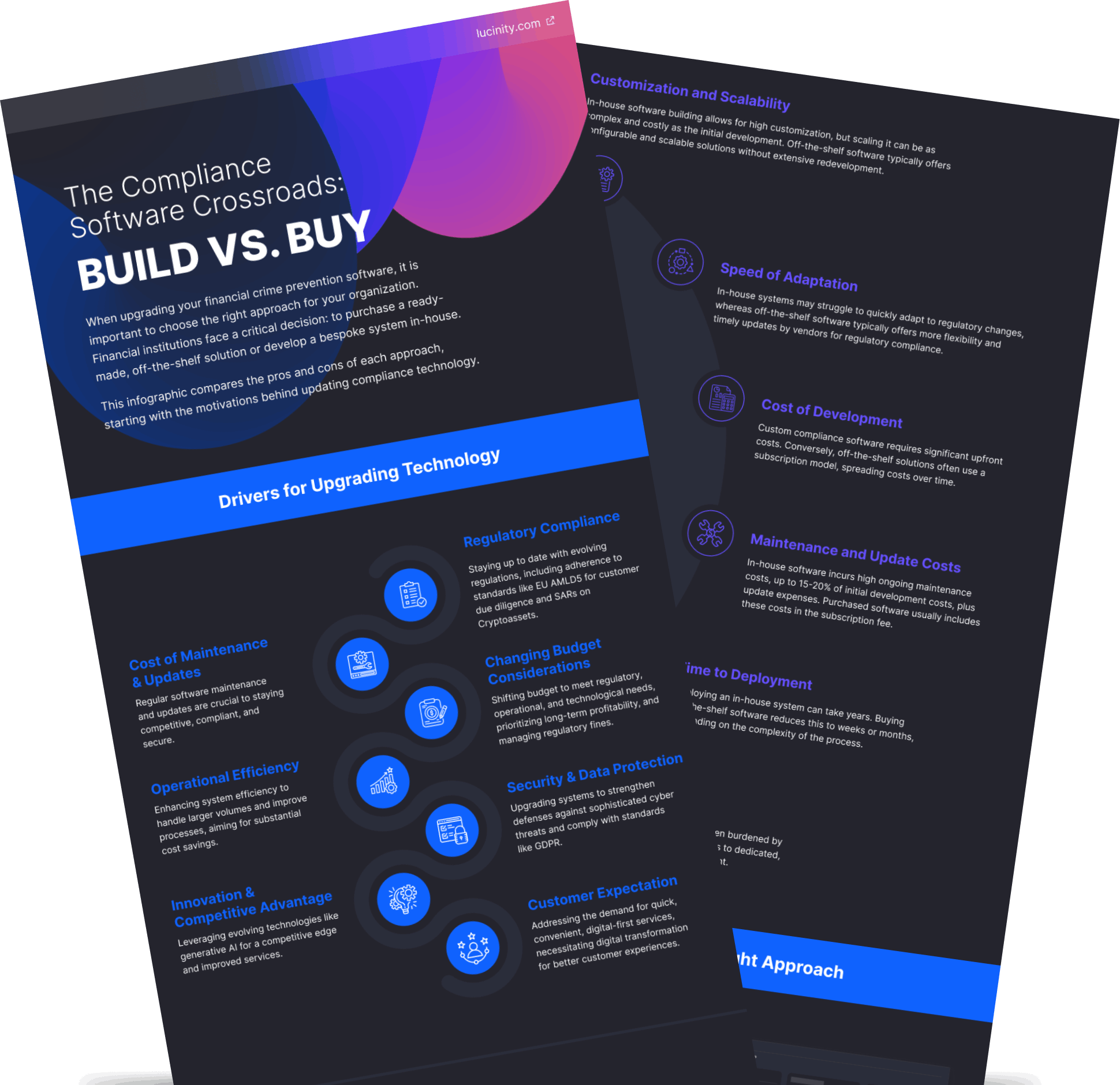

Infographic: Build vs. Buy

The Compliance Software Crossroads

When upgrading your financial crime prevention software, it is important to choose the right approach for your organization. Financial institutions face a critical decision: to purchase a ready- made, off-the-shelf solution or develop a bespoke system in-house.

This infographic compares the pros and cons of each approach, starting with the motivations behind updating compliance technology.

Infographic: Lucinity Solution Overview

Challenges for FinCrime Prevention Team Leaders

This infographic provides an overview of common challenges faced by FinCrime prevention team leaders. It showcases how Lucinity's solutions are uniquely positioned to tackle these issues, optimizing operations and improving decision-making processes.

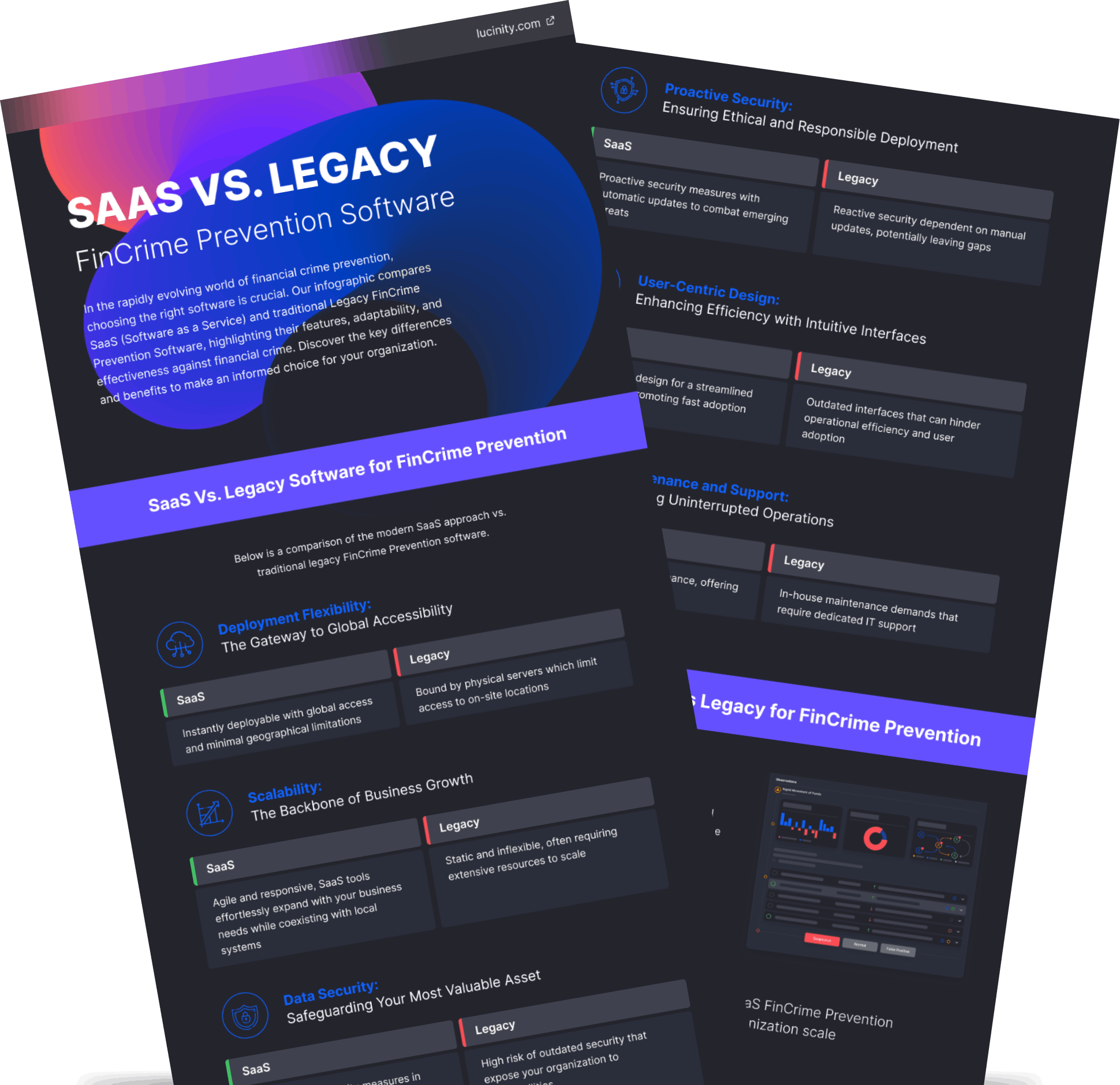

Infographic: SaaS vs. Legacy

Choosing the Right FinCrime Prevention Software

This infographic compares SaaS (Software as a Service) and traditional Legacy FinCrime Prevention Software, highlighting their features, adaptability, and effectiveness against financial crime. Discover the key considerations to keep in mind when moving from legacy to SaaS software.

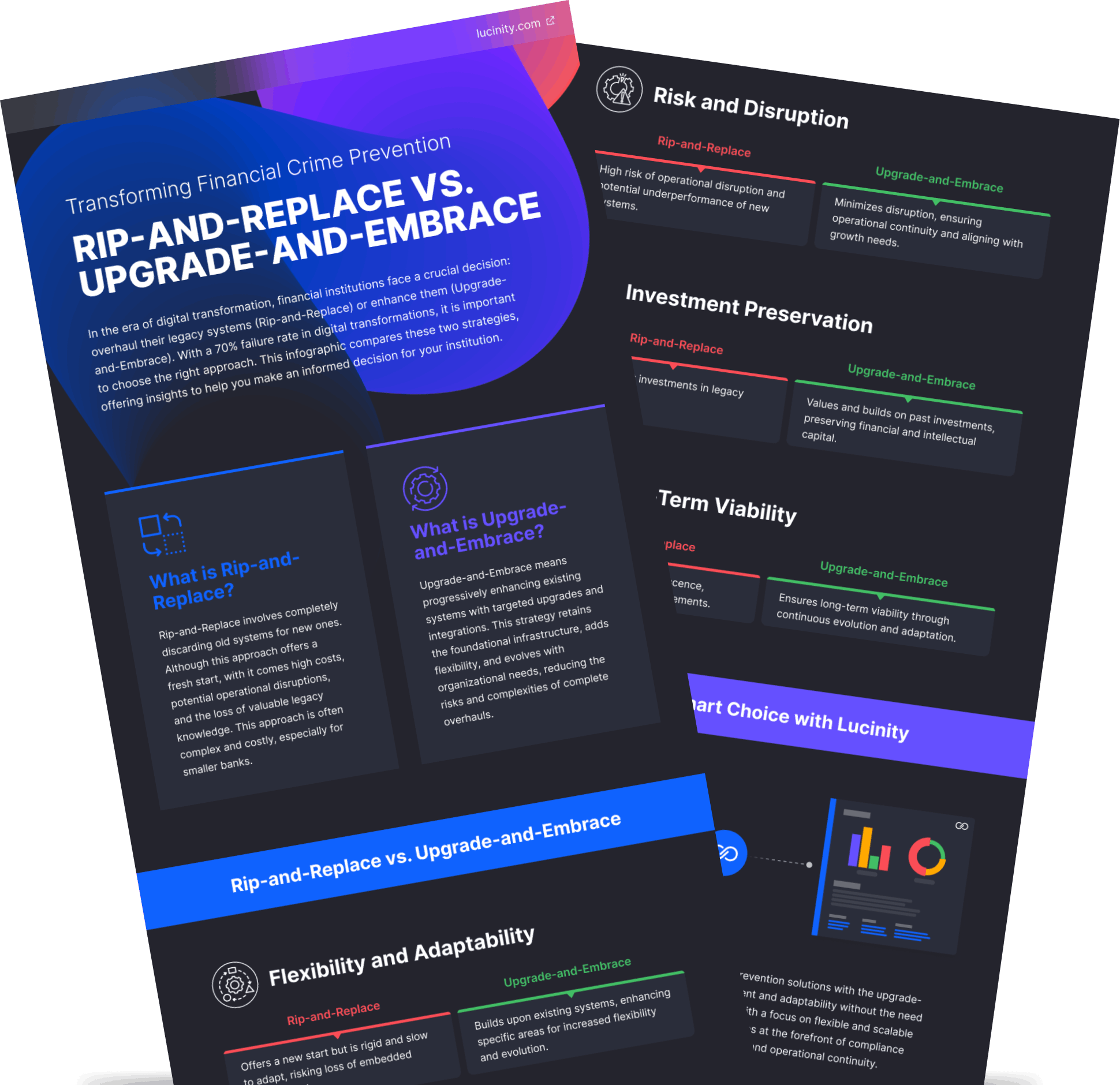

Infographic: Rip-and-Replace vs. Upgrade-and-Embrace

Upgrading Your Compliance Software

In the era of digital transformation, financial institutions face a crucial decision: overhaul their legacy systems (Rip-and-Replace) or enhance them (Upgrade- and-Embrace). With a 70% failure rate in digital transformations, it is important to choose the right approach. This infographic compares these two strategies, offering insights to help you upgrade your compliance software in the most efficient manner.

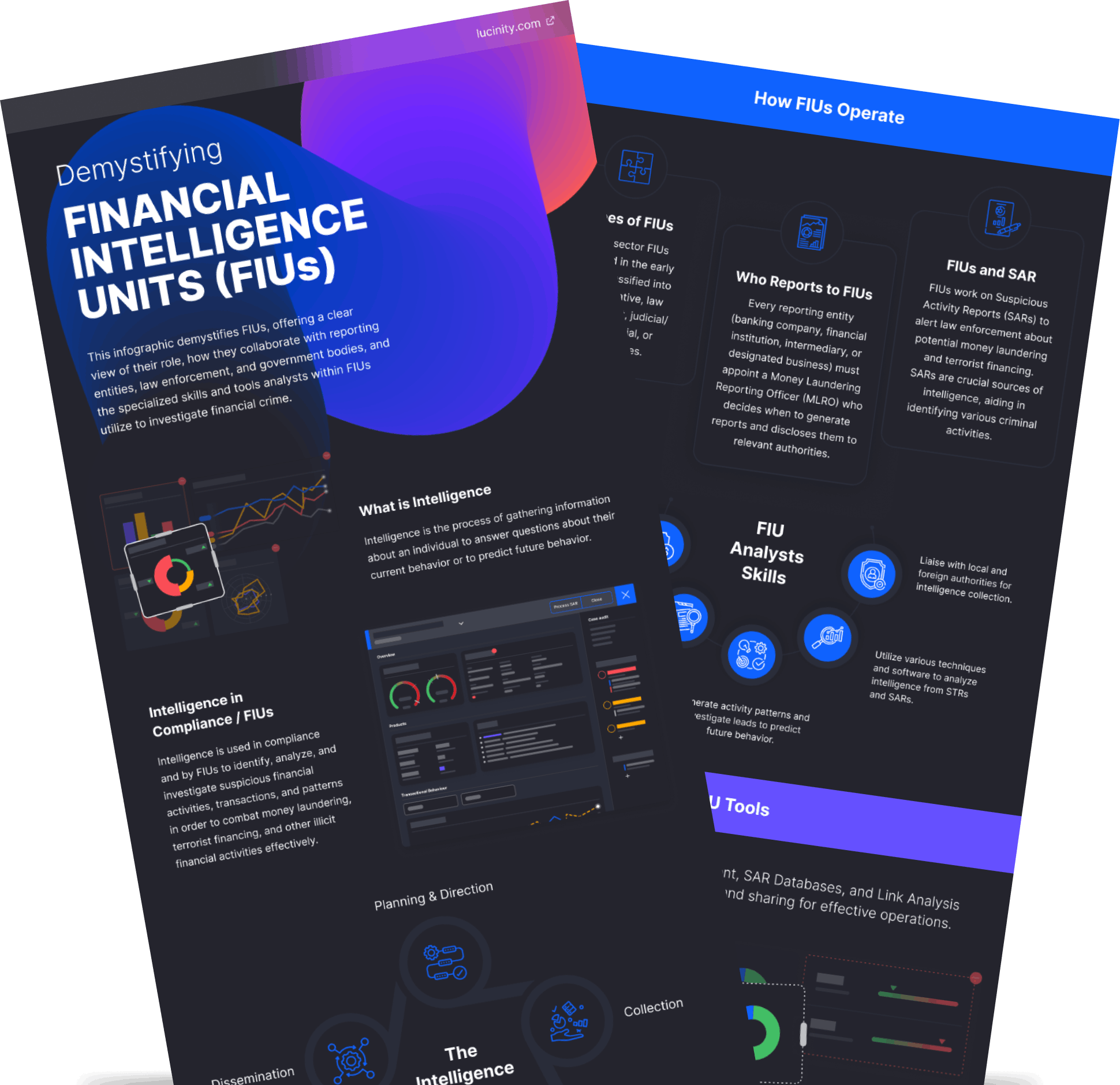

Infographic: Demistifying Financial Intelligence Units (FIUs)

Overview of FIUs' Role, Skills, and Tools

This infographic demystifies FIUs, offering a clear view of their role, how they collaborate with reporting entities, law enforcement, and government bodies, and the specialized skills and tools analysts within FIUs utilize to investigate financial crime.

Infographic: Generative AI Glossary

An Introduction for FinCrime Prevention Professionals

Generative AI is transforming financial technology, extending its reach from technology teams to broader strategic applications in finance, compliance, and customer service. McKinsey & Company highlights this trend, noting the potential for AI to unlock up to $1 trillion in additional value annually for global banking.

This infographic lists some core concepts and technologies to familiarize finance professionals with the landscape of Generative AI, and some ethical considerations of using Generative AI.

Infographic: A Guide to Global FIUs

Key FIUs Around the Globe

Financial Intelligence Units (FIUs) are specialized government agencies focused on receiving, analyzing, and disseminating information related to money laundering, terrorist financing, and economic offenses. Their crucial role in global financial regulation involves collaborating through networks like the Egmont Group, uniting 170 FIUs worldwide. The infographic highlights the purpose of FIUs and the global system of FIUs.

Infographic: SARs Reimagined

How Generative AI is Shaping Financial Intelligence

The infographic highlights how generative AI and copilots are transforming Suspicious Activity Reporting, making the process more consistent and efficient, and enabling compliance teams to generate higher-quality reports.

Currencycloud Q&A

Behind the Scenes with Billy Pinder: A Conversation on Currencycloud's Collaboration with Lucinity

Get firsthand insights from Billy himself! In this Q&A document, Lucinity engages in a candid conversation with Billy Pinder, Head of Transaction Monitoring at Currencycloud, shedding light on his experiences collaborating with the Lucinity team. Discover the invaluable benefits reaped from harnessing Actor Intelligence and delve into the remarkable journey of Currencycloud as it continues to optimize its FinCrime prevention endeavors. Download the document to gain deeper insights into this enlightening discussion.

Microsoft & Lucinity Case Study

Lucinity Employs Microsoft Azure OpenAI to Revolutionize Anti-Money Laundering Measures

This study between Lucinity and Microsoft explores their collaborative use of Azure OpenAI to enhance anti-money laundering strategies. Lucinity, leveraging this technology, significantly improves efficiency in financial crime analysis, integrating customer data to create detailed profiles. This method boosts the speed and accuracy of identifying suspicious activities, demonstrating a notable advancement in financial crime prevention.

Project Aurora Report

The power of data, technology, and collaboration to combat money laundering across institutions and borders

This comprehensive report produced by the Bank of International Settlements (BIS) Nordic Innovation Hub and Lucinity explores the power of data, technology, and collaboration to combat cross-border money laundering. The report expands on the array of technologies employed in the project's proof of concept, including synthetic data generation, machine learning techniques, privacy-enhancing technologies, as well as collaborative analysis and learning methodologies.

Humans ❤️ Intelligence Whitepaper

Empowering Financial Crime Prevention Teams through Augmented Intelligence

Artificial Intelligence is a more accurate, time-saving tool when used in conjunction with human cognition. Also known as Human AI, augmented intelligence, or contextual intelligence, this winning combination effectively fights financial crime and increases profitability.

Download our white paper to gain insights into:

- How financial institutions are using augmented intelligence to reduce operating costs by 28%

- How to minimize false positive fatigue while increasing productivity by 40%

- Defining best practices for Human AI setups that increase reporting accuracy and reduce compliance burnout

7 Compliance & FinCrime Trends for 2023

AI, UBOs, Crypto and Digital Assets, Crime-as-a-Service, Compliance as a Partner

Lucinity delves into the evolving landscape of financial crime and compliance, shaped significantly by rising geopolitical tensions among global powers like the United States, Russia, and China. These dynamics are set to strongly influence the compliance agenda in 2023, heralding an era of increased regulatory scrutiny and tightening measures. Our expert analysis outlines the anticipated key trends for the coming year, offering a forward-looking perspective for financial crime prevention professionals.