Project Aurora

New Report

The power of data, technology and collaboration to combat money laundering across institutions and borders

This comprehensive report delves into Project Aurora, shedding light on its objectives, methodology, key findings, and the emerging trends and opportunities it presents. The report expands on the array of technologies employed in the project's proof of concept, including synthetic data generation, machine learning techniques, privacy-enhancing technologies, as well as collaborative analysis and learning methodologies.

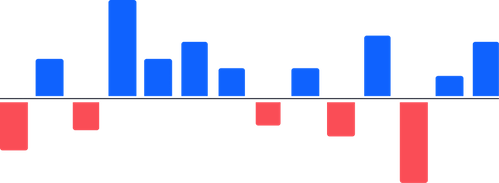

Three-Step Methodology for Project Aurora

Part 1: Synthetic Data Generation

First, we generated a synthetic dataset representing transactions between financial institutions, individuals and businesses within a country and across borders.

*The dataset also included complex money laundering events.

Part 2: Testing Machine Learning Models

We applied different machine learning models to various views of payments data and measured the effectiveness of each in detecting money laundering networks.

Part 3: Testing Privacy Enhancing Technologies

Then, we applied privacy enhancing technologies (PETs) to securely protect the data while testing the effectiveness of the machine learning models in catching money laundering networks.

Key Insights from Project Aurora

Project Aurora shows the benefits of using payment data, privacy-enhancing technologies, machine learning, and network analysis to detect complex money laundering schemes. It explores collaborative analysis and learning arrangements, bringing together data and technologies from different sources to counter money laundering at both national and international levels. The project proves that collaborative approaches are more effective than the current isolated approach by financial institutions in detecting money laundering networks.

To effectively detect and combat suspicious activities beyond individual financial institutions and national borders, having a comprehensive view of payments data is crucial. By leveraging this data, monitoring capabilities can be enhanced, providing insights into transaction networks and uncovering money laundering networks.

Utilizing network analysis and focusing on overall behavior of suspicious networks improves detection capabilities, reducing false alerts. The project also highlights the benefits of a centralized approach that consolidates privacy-enhanced transaction data at a national level and promotes cross-border collaboration while respecting data privacy.

Money laundering presents an intricate data challenge, as it is one of the hardest activities to detect in the world of financial crime. Project Aurora demonstrates how technology can provide better tools to face these challenges. However, technology on its own is not a silver bullet and requires new approaches to strong public and private collaboration, supported by a legal and regulatory framework. It takes a network to defeat a network.

About the BIS Innovation Hub Nordic Centre

The Bank of International Settlements (BIS) Innovation Hub develops public goods in the technology space to support central banks and improve the functioning of the financial system. It has centres around the world and a global network of central bank experts on innovation. The BIS Innovation Hub Nordic Centre in Stockholm was established in 2021 by BIS in collaboration with Danmarks Nationalbank, Central Bank of Iceland, Norges Bank and Sveriges Riksbank.