Currencycloud x Lucinity

Challenge

The Turning Point: The Search for a Scalable Solution

In 2021, Currencycloud stood at the forefront of innovation, keenly aware of the challenges and opportunities that lay ahead. As a company committed to delivering a seamless customer experience, Currencycloud aimed to fine-tune its procedures for investigating suspicious transactions. Previously, the team had relied on a detailed but manual approach, which not only consumed valuable time but also lacked the comprehensive technological support needed to fully understand their clients' activities.

Recognizing the immense untapped potential within its FinCrime Prevention team, Currencycloud began exploring avenues for more effective data utilization to reveal key insights into customer behavior. Committed to sustaining its rapid business growth without compromising on quality, the company set out to find external specialists who could help augment their in-house capabilities. The goal was simple yet transformative: empower their analysts to make quicker, smarter decisions through better data visibility and context. Far from being daunted by the complexities of scaling, Currencycloud saw this challenge as an exciting milestone in their journey towards operational excellence.

Decision

Choosing the Right Partner: Currencycloud's Decision to Team Up with Lucinity

After a comprehensive search for a vendor who could truly understand their complex needs, Currencycloud discovered Lucinity and immediately saw the potential for a transformative partnership. Intrigued by Lucinity's innovative suite of products and unique Actor Intelligence, Currencycloud recognized a solution that could seamlessly integrate into their existing frameworks without disrupting current operations. Lucinity's ability to demystify complex transactional relationships and hierarchies allowed Currencycloud to gain unprecedented clarity into its own operations.

But what truly sealed the deal was Lucinity's team approach. From the outset, Lucinity demonstrated a genuine commitment to creating long-term value, providing assurances that they would be there for Currencycloud not just in the initial phases, but as a continual support system as the company scaled. Unlike other vendors, Lucinity took the time to listen intently, delving deeply into Currencycloud's specific challenges during discovery sessions and even shadowing their analysts to gain firsthand knowledge of their daily activities. This level of attention to detail and genuine interest in co-solving problems convinced Currencycloud that Lucinity wasn't just another vendor, but a strategic partner for the long haul.

Solution

A New Era in FinCrime Prevention: Currencycloud Implements Lucinity's Actor Intelligence

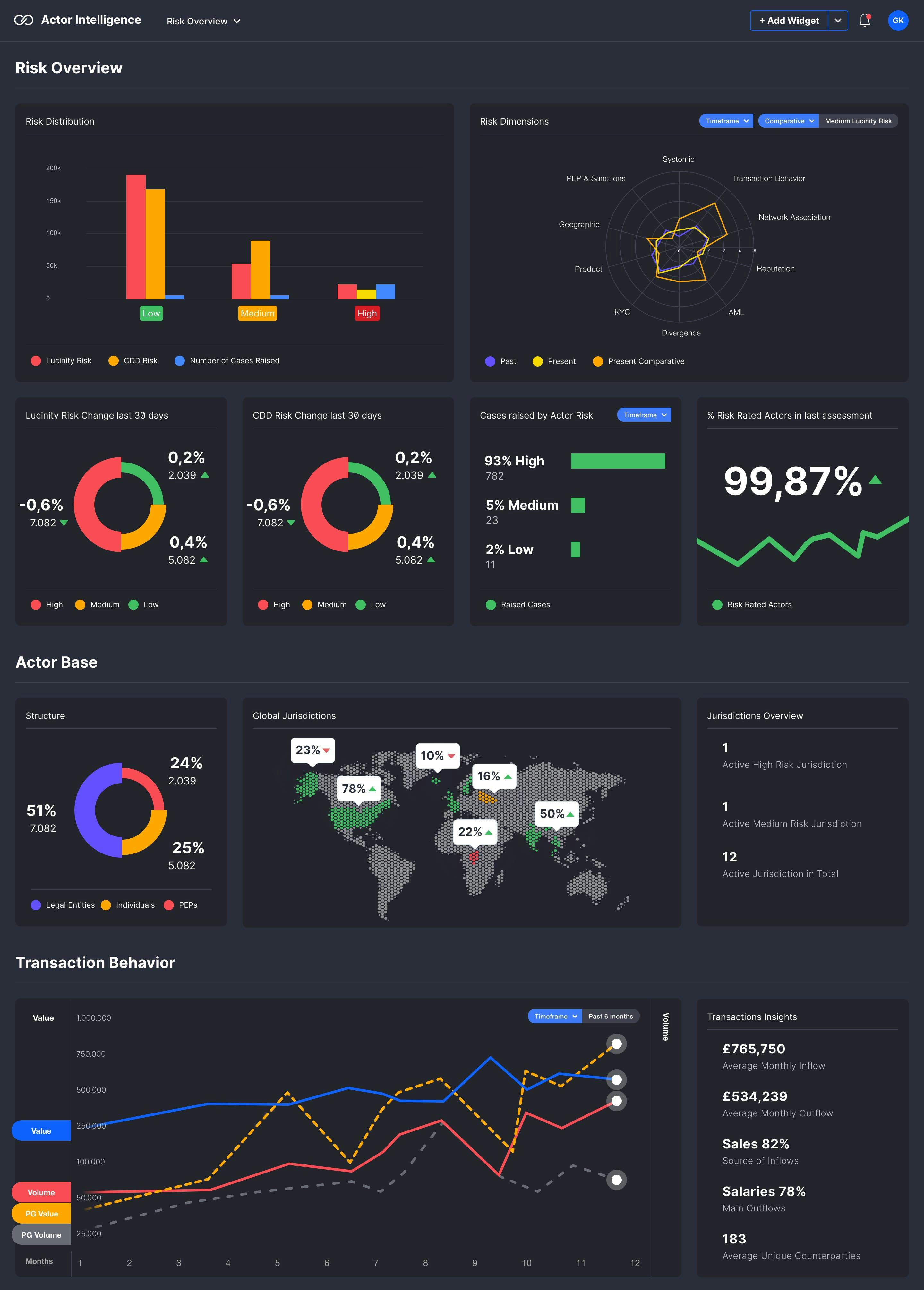

After selecting Lucinity as its preferred partner, Lucinity implemented the Actor Intelligence solution for Currencycloud's FinCrime Prevention team. This sophisticated tool became an integral part of Currencycloud's daily operations. Lucinity's Actor Intelligence brings together disparate pieces of information about customers into a centralized platform, allowing analysts to quickly and comprehensively understand customer behavior.

Actor Intelligence is an advanced technology platform that provides an all-encompassing perspective into customer accounts and transactional activities. Designed for ease of use without compromising on analytical power, it integrates key functionalities such as real-time customer risk assessment, a unified view of individual customer profiles, and sophisticated anomaly detection capabilities. The solution is engineered to simplify intricate data points, offering a streamlined approach to risk management and decision-making within the fast-paced and complex landscape of FinCrime Prevention.

Benefits of Actor Intelligence

Risk Management

Stay ahead with automatically updated customer risk scores and behavior analysis

Unified Customer View

Gain a complete view of each actor, integrating KYC, product, and external data

Visualize Trends

Spot trends, anomalies, and patterns in customer transactions with ease

Results

Currencycloud’s Journey to Faster, Smarter Decision-Making

With the integration of Lucinity's Actor Intelligence, Currencycloud has substantially streamlined its FinCrime Prevention operations. The platform serves as a one-stop shop for analysts, providing a holistic view of customer behavior and associated risks. The continuous risk scoring feature has made decision-making quicker and more accurate. Before adopting Actor Intelligence, Currencycloud's analysts had to sift through multiple systems to collate necessary data. Now, all of that information is centralized, enabling analysts to understand their customers in a much more efficient manner.

Actor Intelligence not only provides high-quality visualizations but also offers an intuitive user interface that allows analysts to easily configure what they see. This adaptability empowers them to delve deeper into transactions and make more informed decisions, thereby significantly reducing the time spent on each case. The efficiency gains have been instrumental across all levels of complexity in investigations, enabling analysts to swiftly determine whether a specific pattern of behavior warrants further investigation. This transition to Actor Intelligence has positioned Currencycloud as an industry leader in leveraging technology to augment human expertise in FinCrime Prevention.

"Lucinity has built a brilliant solution that is supporting us as leaders in compliance. Lucinity is helping us on our journey towards basing intelligence on customer behaviors."

Next Steps

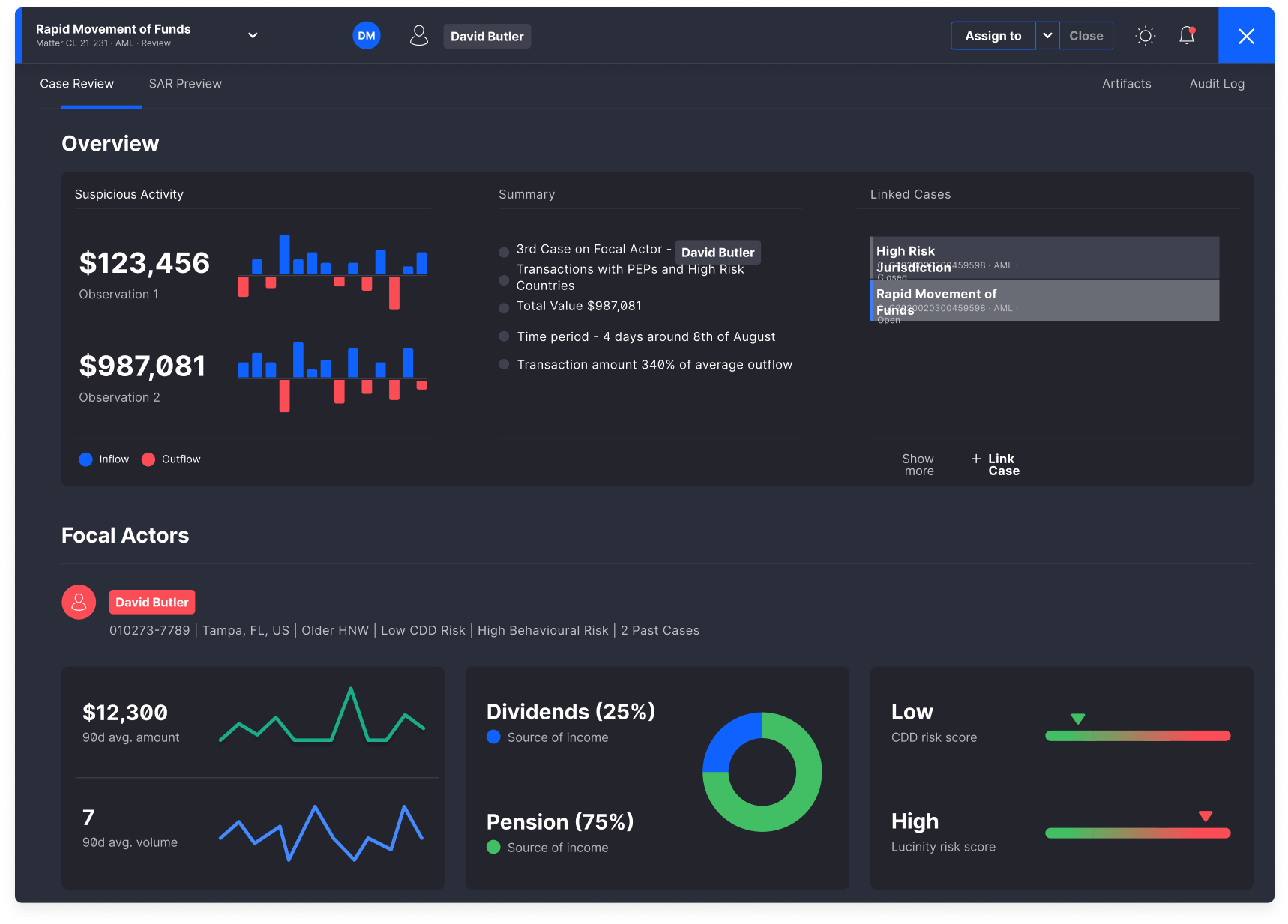

Ongoing Innovation: Currencycloud Upscales with Lucinity’s Case Manager

In a bid to continually elevate its FinCrime Prevention efforts, Currencycloud once again chose to innovate in 2022. Having already seen measurable success with Lucinity's Actor Intelligence, the company sought to further consolidate and streamline its operations. Previously burdened by the need to switch between multiple platforms for case information, the team recognized the need for a more unified, efficient system. While the prospect of building an in-house solution was considered, the time and resources required for such an endeavor were deemed impractical.

Given the trust and partnership already established with Lucinity, Currencycloud confidently expanded its engagement by adopting Lucinity's Case Manager. This move was far from arbitrary; it was motivated by the impressive results previously observed with Actor Intelligence, as well as the alignment of both companies' visions for ethical and efficient financial operations. Lucinity’s Case Manager now serves as the center for Currencycloud's compliance initiatives, combining alerts, workflow management, and the powerful analytics of Actor Intelligence into a single, user-friendly platform. The result is a significant enhancement in both speed and productivity, enabling analysts to work more intelligently and cohesively, thereby adding another layer of integrity and efficacy to Currencycloud's FinCrime Prevention strategies.

Q&A with Currencycloud

Behind the Scenes with Billy Pinder: A Conversation on Currencycloud's Collaboration with Lucinity

Get firsthand insights from Billy himself! In this Q&A document, Lucinity engages in a candid conversation with Billy Pinder, Head of Transaction Monitoring at Currencycloud, shedding light on his experiences collaborating with the Lucinity team. Discover the invaluable benefits reaped from harnessing Actor Intelligence and delve into the remarkable journey of Currencycloud as it continues to optimize its FinCrime prevention endeavors. Download the document to gain deeper insights into this enlightening discussion.

About Currencycloud

Pioneering Global Payments with Speed, Transparency, and Innovation

Currencycloud is a fintech company specializing in global payments and foreign exchange solutions. Founded in 2012, the company has developed cutting-edge cloud-based infrastructure to simplify complex cross-border transactions for businesses worldwide. By offering a range of Application Programming Interfaces (APIs), Currencycloud has empowered banks, financial service providers, and fintech companies to execute quick and seamless international payments in multiple currencies. The company made headlines in 2021 when it was acquired by Visa in a £700 million deal, a strategic move that has significantly expanded its reach and capabilities. Now, having processed more than $75 billion USD in payments and facilitated money transfers to over 180 countries, Currencycloud is a growing, innovative player in the fintech space, committed to delivering transparency, speed, and simplicity to its diverse global clientele.