Covid-19: The new laundromat

While communities’ worldwide band together during trying times, scientists collaborate and human compassion is on full display, some rotten apples take advantage of the situation.

Global financial crises and economic recessions are devastating to almost everyone. While communities’ worldwide band together during trying times, scientists collaborate and human compassion is on full display, some rotten apples take advantage of the situation.

Crises and change fuel criminals

Money launderers, fuelled by big money from crimes such as drug, human, and weapons trafficking as well as terrorist financing, are equipped to expertly exploit the current climate. As the media and the global population is occupied with news relating to COVID-19, and people increasingly work from home, we are left in a vulnerable state.

As we all know by now, our behavior changes in periods of crisis. And our financial behavior is certainly not excluded. Transaction patterns and spending differ drastically from the average. This makes it troublesome for existing rule-based AML models to correctly distinguish between illicit and normal customer behavior. Consequently, money launderers, who are backed by billions of dirty dollars, can try new, sophisticated methods to efficiently launder money and hide from outdated detection systems.

A new transaction normal

Criminal networks are always on the lookout for new schemes, better and more efficient ways to make their money appear legitimate. A global crisis is the perfect setting for significant innovation on their part. Money launderers use the opportunity to emulate ‘normal’ transaction patterns during abnormal times. Doing so increases their likelihood of going undetected as legacy AML systems only utilize basic rules or statistical concepts, which can surely be bypassed.

The current pandemic forces large parts of the world to stay at home. Resulting in an unprecedented rapid increase in online orders.

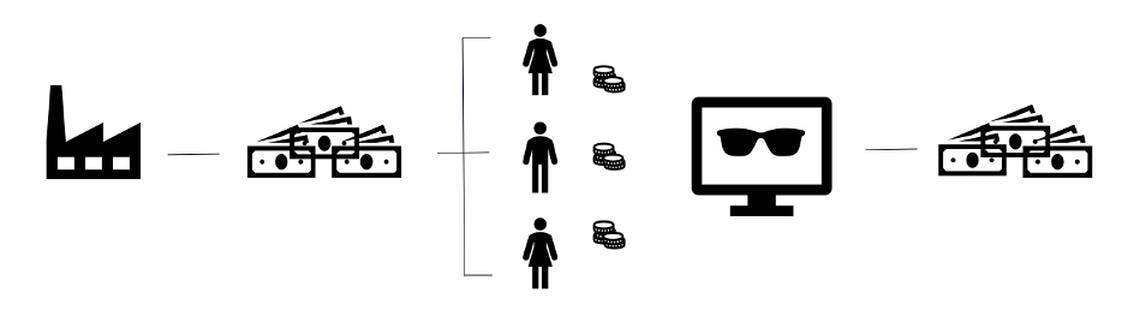

"One way to leverage this situation for criminal benefit is to use 'smurfs' in an online shop controlled by the money laundering entity."

Europol 2020

Smurfs is a term used for people facilitating money laundering by breaking large sums up and distributing them to several individuals and legitimizing the money in these smaller units. The ‘smurfs’ then order from this online shop with the money they were given and thereby make the flow of money appear legitimate, even if they never receive a product. The online shop registers the order and makes a profit. And because of stay at home orders, it is not unusual to see an uptick in online activity, meaning that it is easier to launder more money while appearing legitimate.

It's happening again

This is not the first time that criminals have abused a global recession to further their causes. In the global financial crisis of 2008, the majority of the $352 billion profit attributed directly to drug trafficking was laundered undetected through financial institutions all around the world.

Criminal innovation in money laundering schemes pays the highest interest during volatile periods. Novel approaches require constant evolution from banks’ compliance functions. Modern deep learning methods and algorithms are the strongest tools to shine a light on schemes that facilitate terrible crime. Banks can step up and protect their clients and the financial system for the benefit of all society, but they have to change.

How we can help

At Lucinity, we combat the rise of illicit activity during the COVID-19 crisis by employing a behavioral and actor based approach. Our approach is powered by Human AI and evolves with every processed AML case. Legacy AML systems are struggling to surface illicit behaviors during these high impact times of crisis. This is mainly due to their inability to contextualize changes to transaction behavior that are evident in today’s data. Lucinity’s Human AI AML solution is primed to fight against new advancements in crime. By leveraging its capability of finding abstract patterns, more advanced schemes, and learning from each case – Lucinity is ready to make money good.