That's a wrap!

Lucinity sponsored the AML and FinCrime Tech Forum

On January 31st, Lucinity sponsored the AML & Fincrime Tech Forum. Organized by Fintech Global, the event brought together nearly 400 financial crime professionals across banking and fintech in the UK. In this event, Lucinity had the opportunity to:

- Present on the Demo Stage as a leading-edge innovator in AML. We shared about how Lucinity can help end operational inefficiencies, lower costs, and improve staff retention.

- Hear debates and presentations from financial services leaders and innovators leading the fight against financial crime. See the insights captured below!

- Network with financial crime professionals from various financial institutions and understand their greatest challenges in AML and where they see the industry going.

Key insights from the event

Stay up to date on the latest in AML and FinCrime

Key technological trends in AML:

- ~30 billion transactions are processed each year. Such data must be structured, accurate, and real-time to complement teams that are empowered with tools to interpret data best

- 1% of risk typologies deserve 90% of AML & AFC attention: We need to harmonize frameworks so banks, regulators, and law enforcement can work with leading RegTech vendors to identify and conduct a unified risk screening and monitoring approach

- With regards to AI and Data Science, it's no longer about getting started. To shift the status quo and advance in these fields, it is important to collaborate with experts to investigate the use cases and work to uncover true positives.

Emerging AI (such as chatGPT) can pose as a for AML/AFC for the following reasons:

- It is reducing the resource and expertise needed to engage in fraud and organized crime

- It is increasing the adoption of Crime-as-a-Service

- As storage of data insights increases, it will become more intelligent and more valuable for criminals (e.g. growing challenge of detecting the work of AI vs. humans - makes surveillance and asset recovery efforts more difficult)

We invite you to play around in our platform for free!

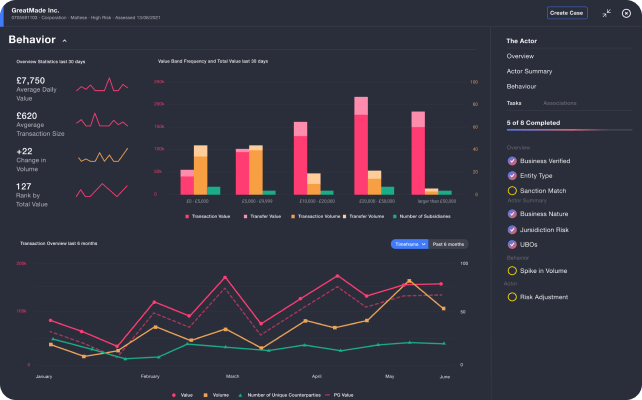

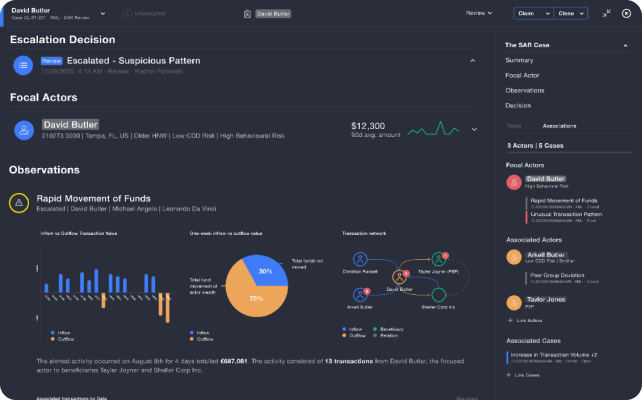

- Experience the power of storytelling in AML through cases focusing on customers and their behavior

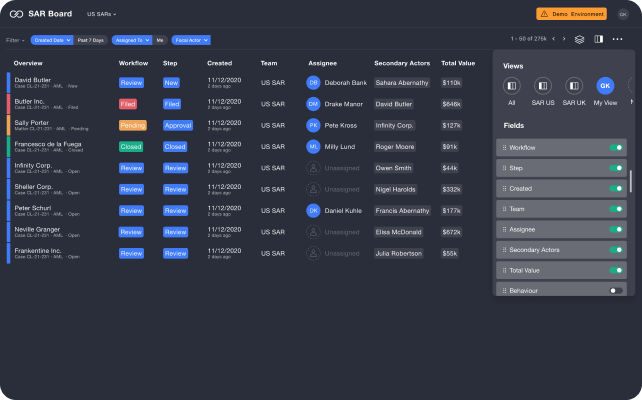

- Explore how you can optimize your anti-money laundering teams’ efforts with a configurable workboard designed for collaboration and efficient workflows

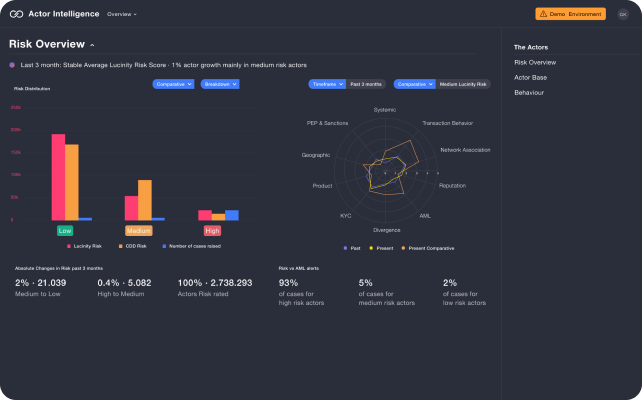

- Dive into customers' behavior with Actor Intelligence and understand their risk rating and transaction patterns