The key to beating money laundering is to do less

Less work, more AML

Make smarter decisions faster

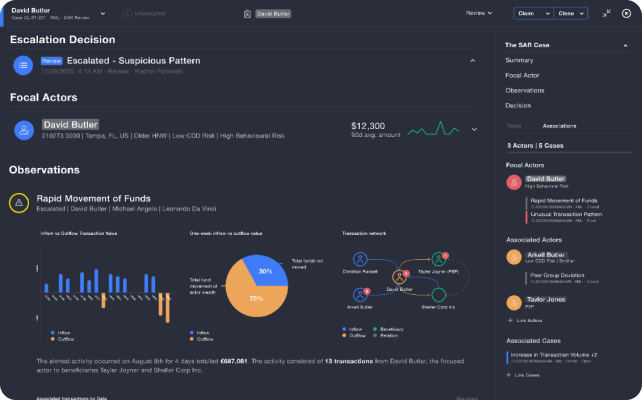

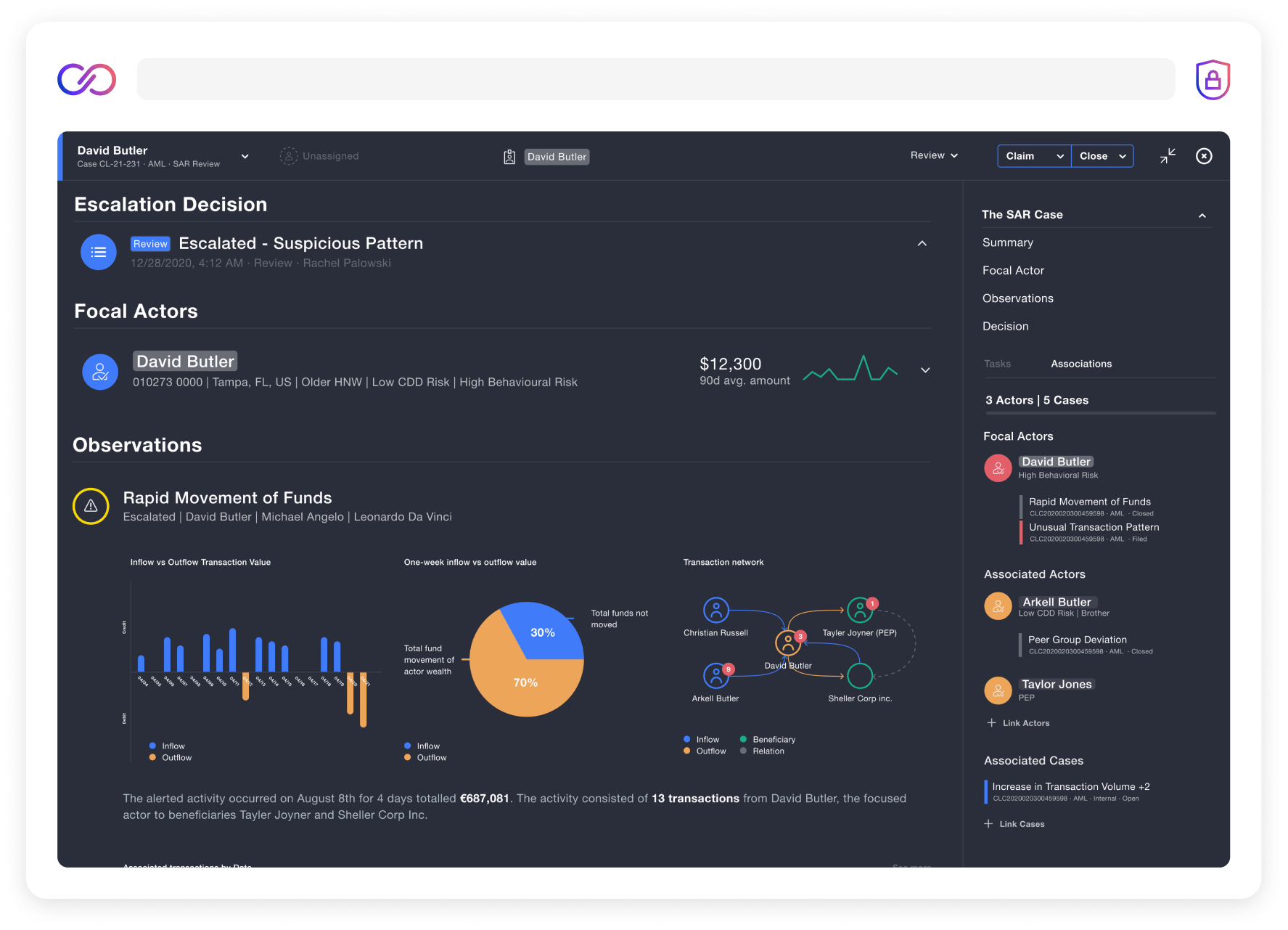

AML can use technology to move from defense to offense and let the analysts' human insight and creativity lead machine power and performance in the fight against financial crime.

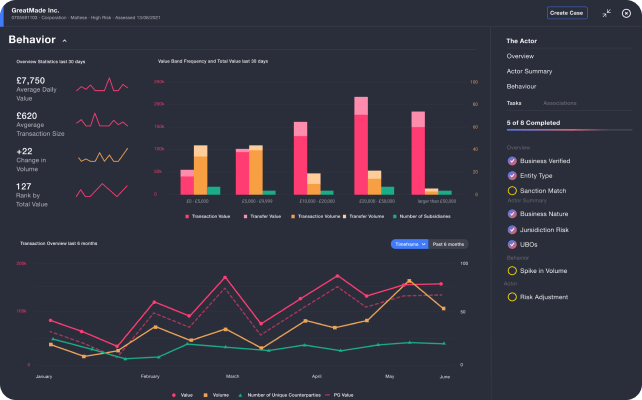

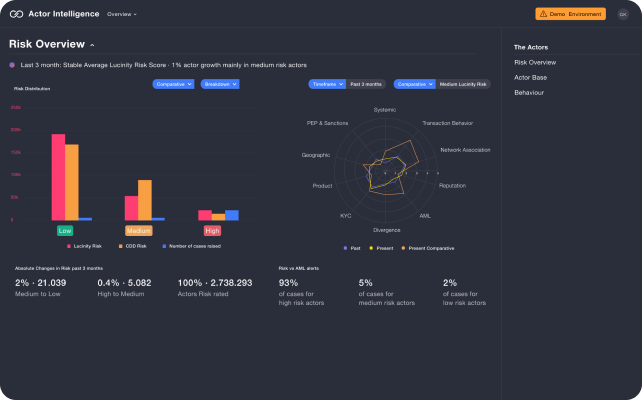

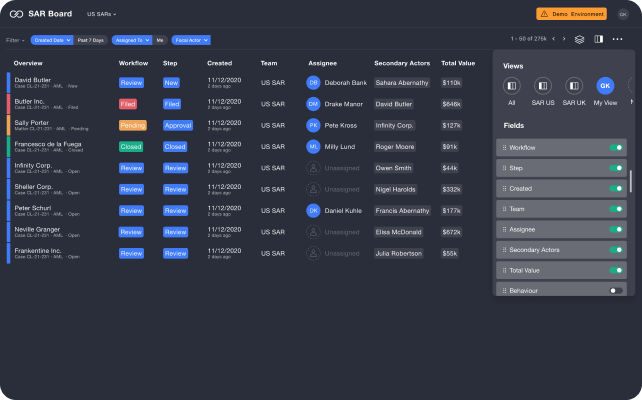

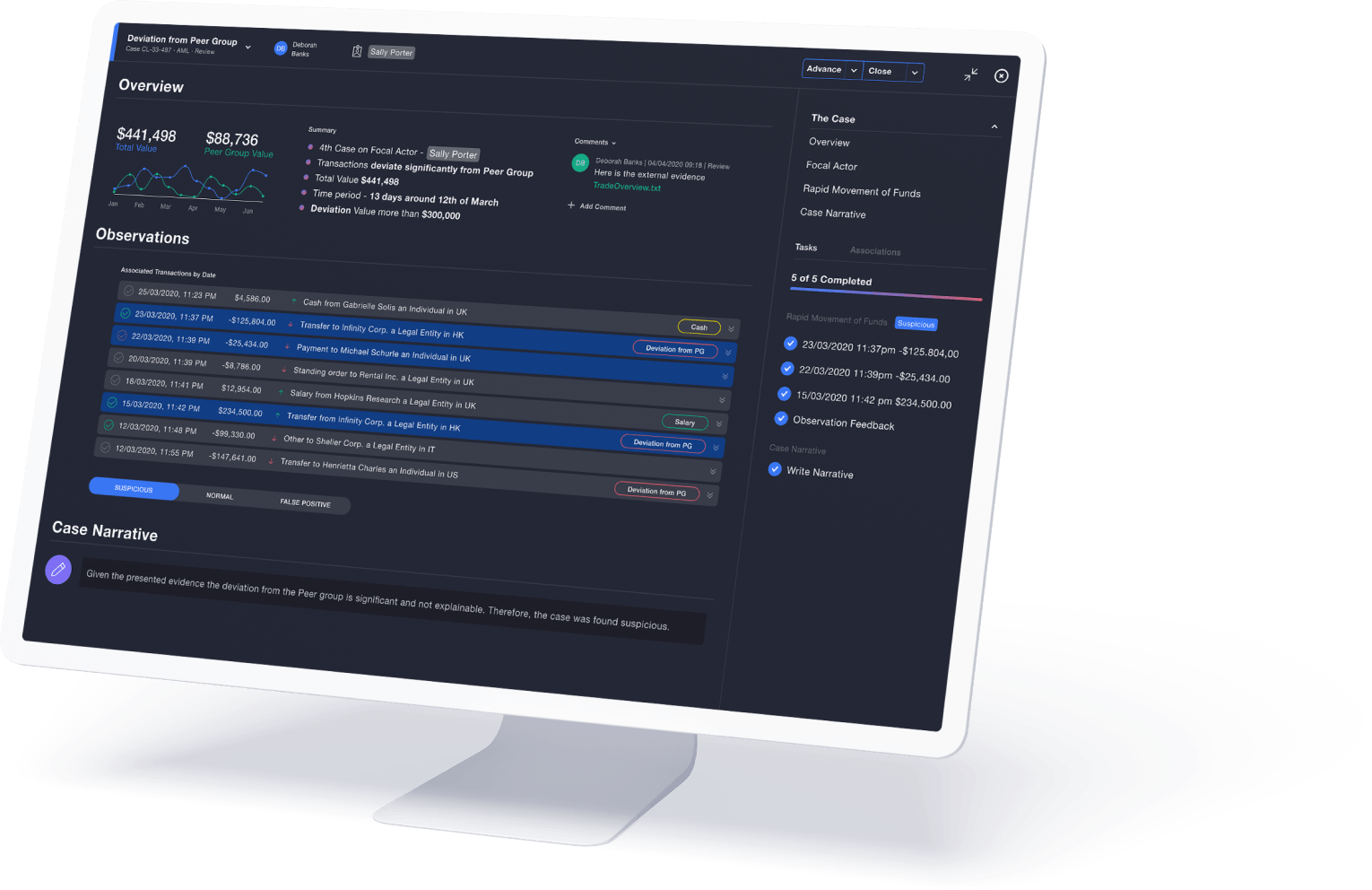

Lucinity's transparent, explainable AI does the heavy lifting with continuously evolving behavior recognition, and presents AML case data ready to be reviewed and filed. Compliance analysts can see exactly where signs of money laundering have been detected and intuitively drill down into the data for details.

No matter how long a game financial criminals might play, your AML team and Lucinity can beat them.

Ready to let Lucinity do the heavy lifting for your AML?

- Compress 80% of the time otherwise spent on collating case data

- Improve end-to-end processes by up to 50%

- Use the 40x+ behavioral insights for continuous, risk-based monitoring

- Reach 4x more true positives than your legacy system

Transaction monitoring

Using augmented intelligence, we are revolutionizing how financial institutions approach, understand, and deal with the ever-evolving threat of money laundering.