The challenges and opportunities within the AML industry

Lucinity shares about the increased regulatory burden that PSPs will experience

In a recent article, Vixio interviews Daníel Pálmason, General Counsel and Head of Compliance at Lucinity, about the challenges and opportunities within the AML industry. The interview focuses on the increased regulatory burden that payment service providers (PSPs) will experience with growing complexities from e-wallets, instant payments, and cryptocurrency.

Increased legal requirements for financial institutions

Resulting in 3x growth in the AML software market

Research indicates that the value of the AML software market is expected to grow from $2.1bn in 2021 to $6.2bn in 2028. This is 3x its current market, driven by increased legal requirements for financial institutions and the increased use of artificial intelligence (AI) tools, according to the Global AML Software Market Analysis Report of 2022.

The need for greater efficiency

Costs are bound to rise in line with increased regulatory burden

PSPs express frustration over legacy service providers that are incompatible with their current tech stack and overburdening their business and resources. As they look for better solutions, they are concerned about losing efficiency in their AML processes.

Rather than wait for new regulation, the article encourages PSPs to implement strong AML and fraud controls proactively. It goes on to explain that the increased use of digital solutions based on AI can help improve AML/CTF measures.

"Banks, furthermore, are increasingly expecting the PSPs that form part of their network to have strong anti–money laundering (AML) and fraud controls in place."

Learn more about Lucinity

Your journey, your way, your compliance

A modular and intelligent compliance solution that adapts to your needs and unique positioning.

Build compliance to last

Lucinity solves your business by solving your compliance needs for the long run.

Compliance: meet payments

A modular compliance hub that adapts to your business, tech stack, and priorities.

We invite you to play around in our platform for free!

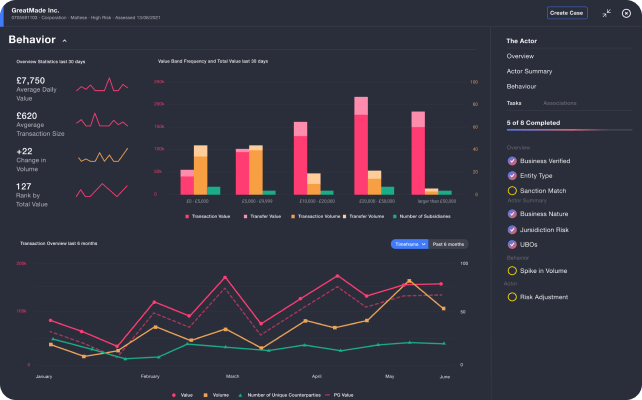

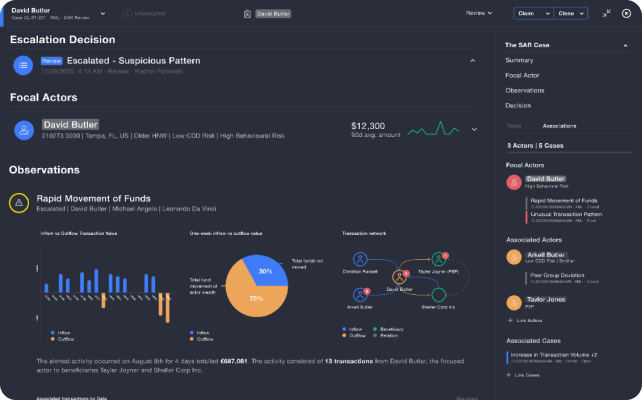

- Experience the power of storytelling in AML through cases focusing on customers and their behavior

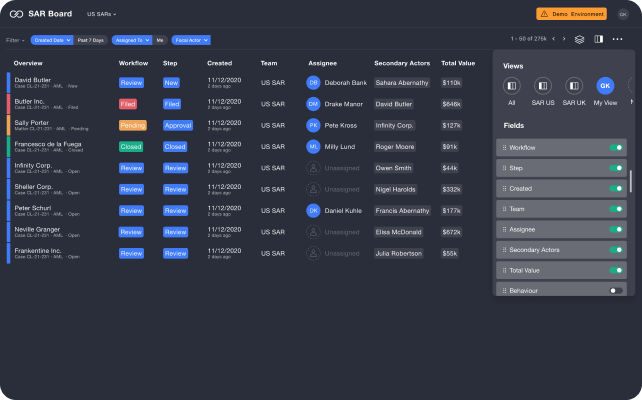

- Explore how you can optimize your anti-money laundering teams’ efforts with a configurable workboard designed for collaboration and efficient workflows

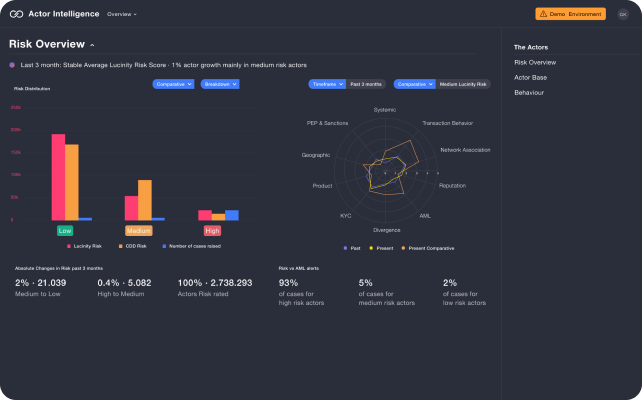

- Dive into customers' behavior with Actor Intelligence and understand their risk rating and transaction patterns