Make Money Good with the Lucinity platform

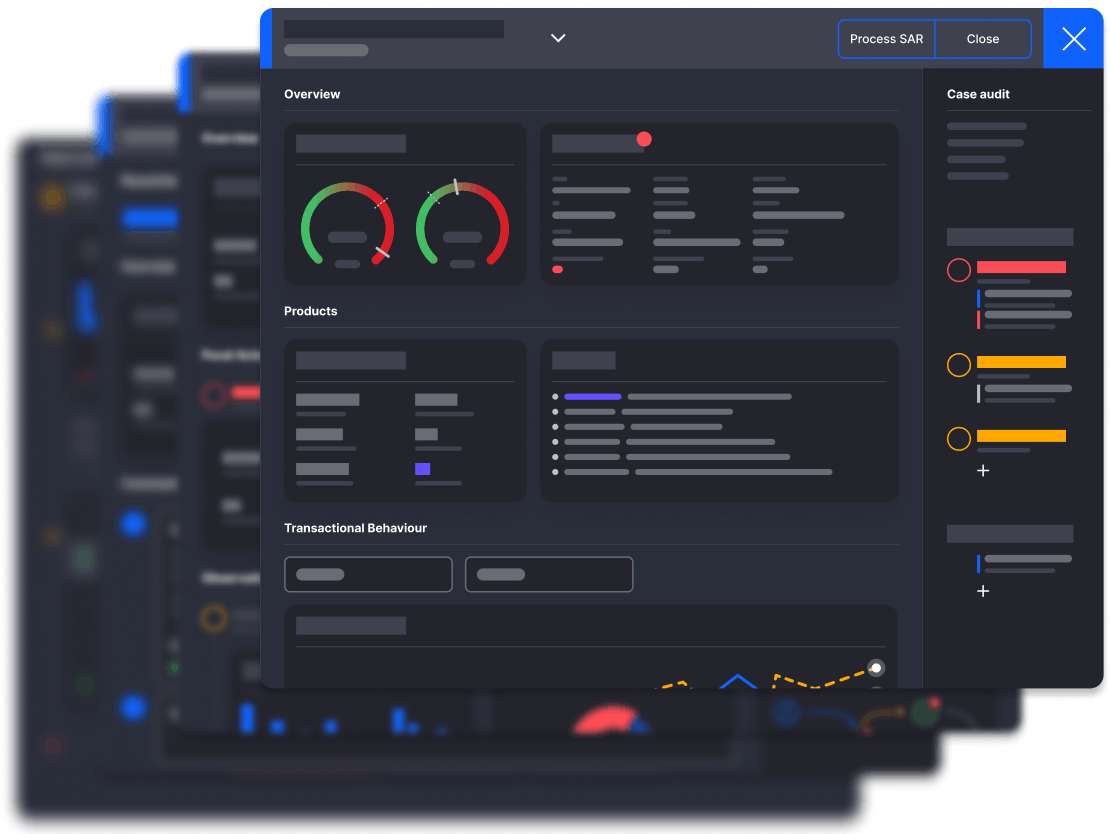

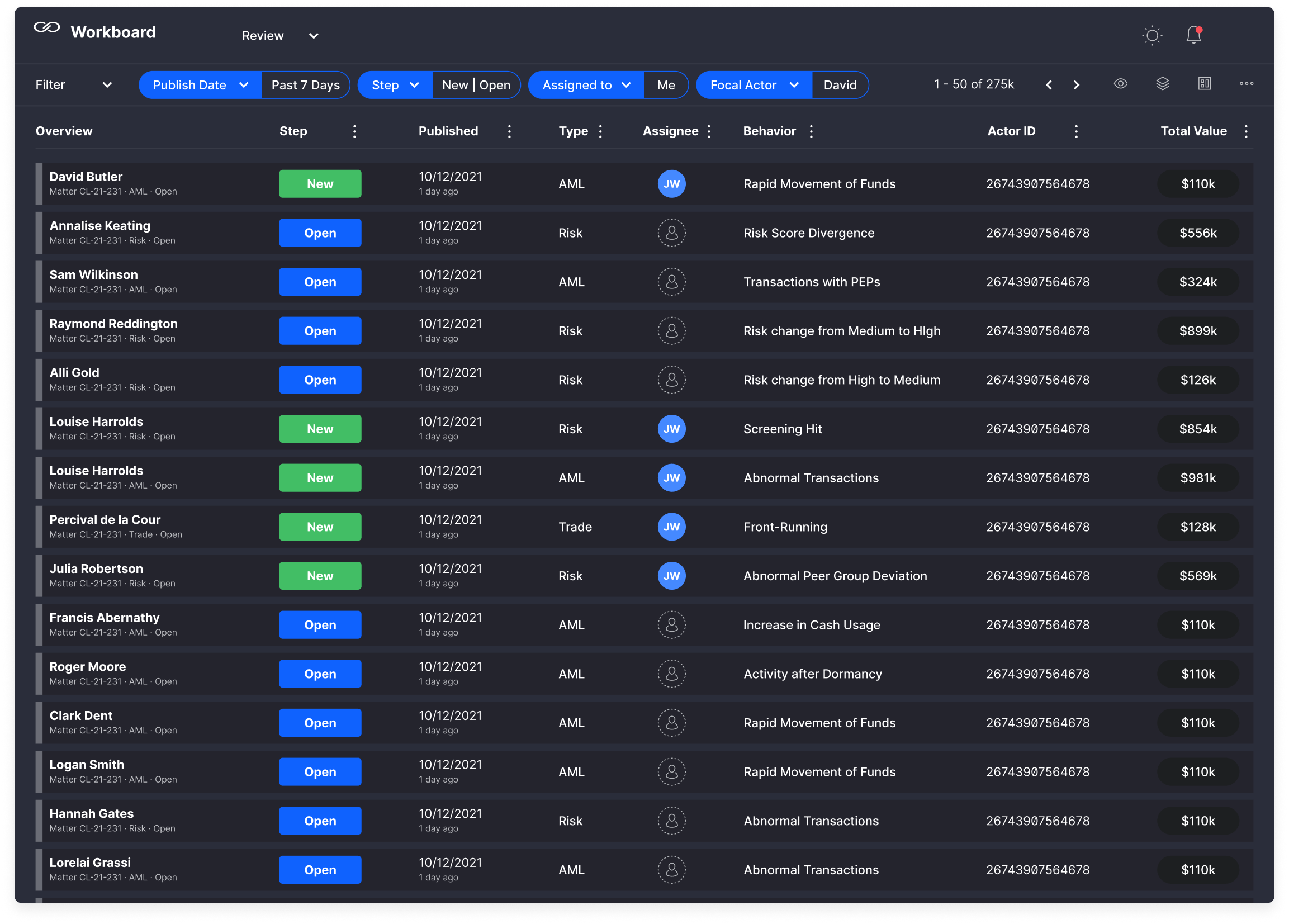

Case Manager

Streamlined, no-nonsense compliance UI and flexible workflows that supercharge your team's productivity.

Streamlined, no-nonsense compliance UI and flexible workflows that supercharge your team's productivity.