Reduce time and cost of AML risk assessment

Comprehensive AML risk assessment based on customer behavior

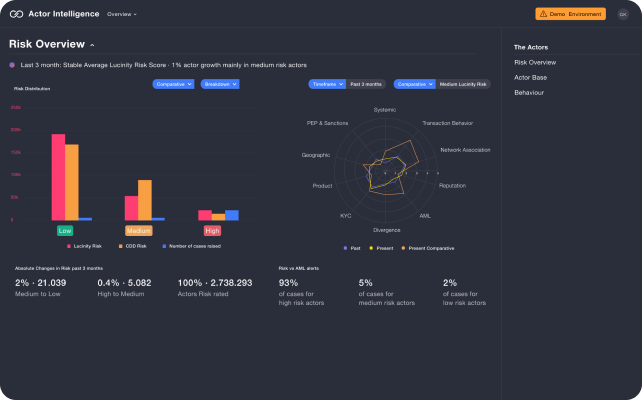

Continuous risk scoring for faster, smarter AML

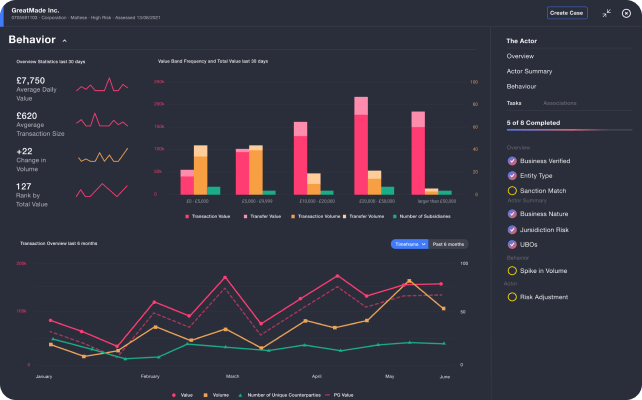

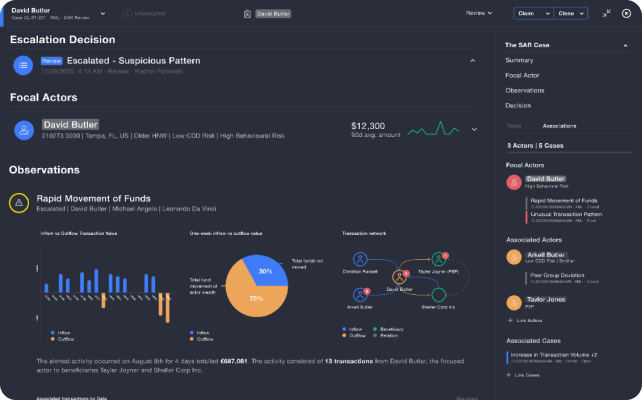

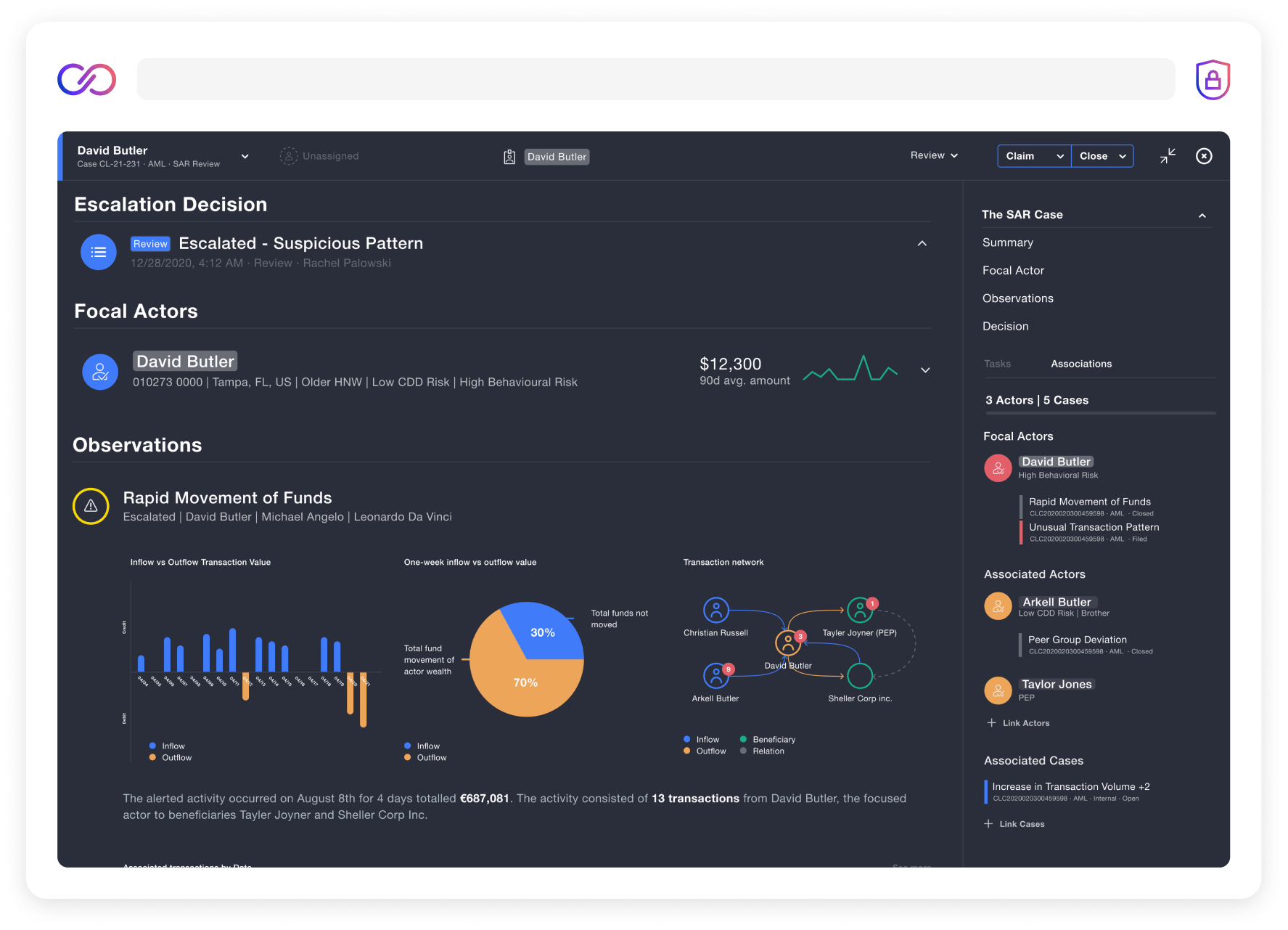

AML risk assessment can be centered around customers and peer groups using the power of behavior-based detection. Risk scores are calculated continuously and automatically, based on a multidimensional data matrix processed by transparent and explainable AI models that learn from your insights.

Lucinity's AML solution allows you to focus on making smarter decisions faster, and feed the AML risk assessment algorithms to further develop your risk scoring.

See how to do AML risk assessment better!

- 40x+ behavior insights unlock holistic risk scoring

- Continuous risk assessment without extra work

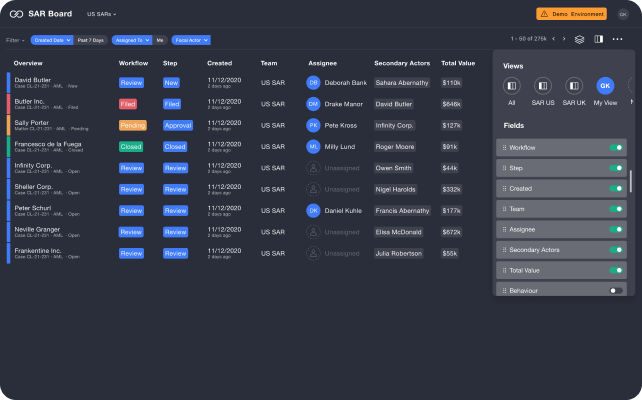

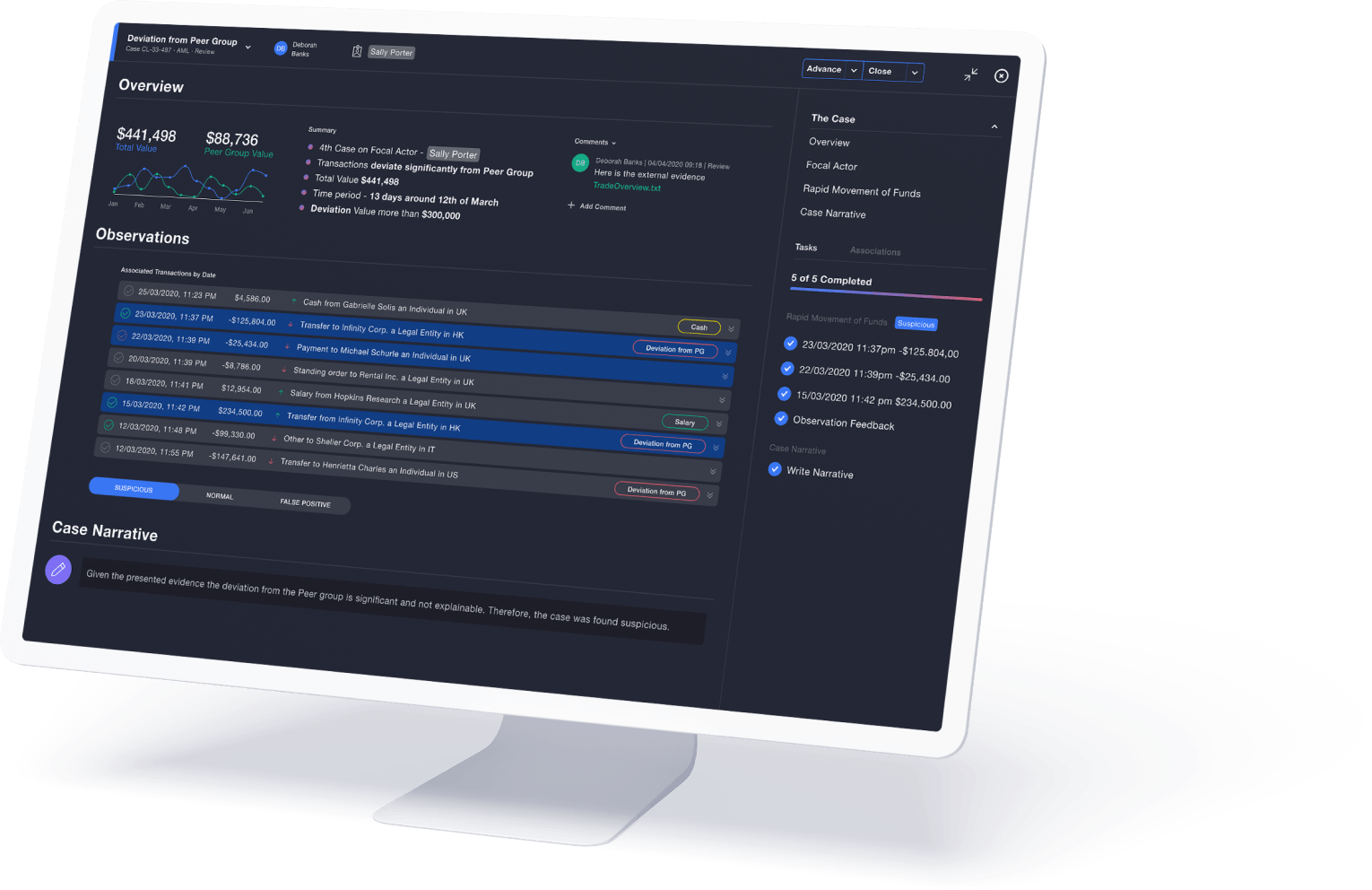

- Intuitive UI to review and explore AML case data

- Self-learning intelligent scoring AML risk models

Transaction monitoring

Using augmented intelligence, we are revolutionizing how financial institutions approach, understand, and deal with the ever-evolving threat of money laundering.