Take the lead with risk-based monitoring

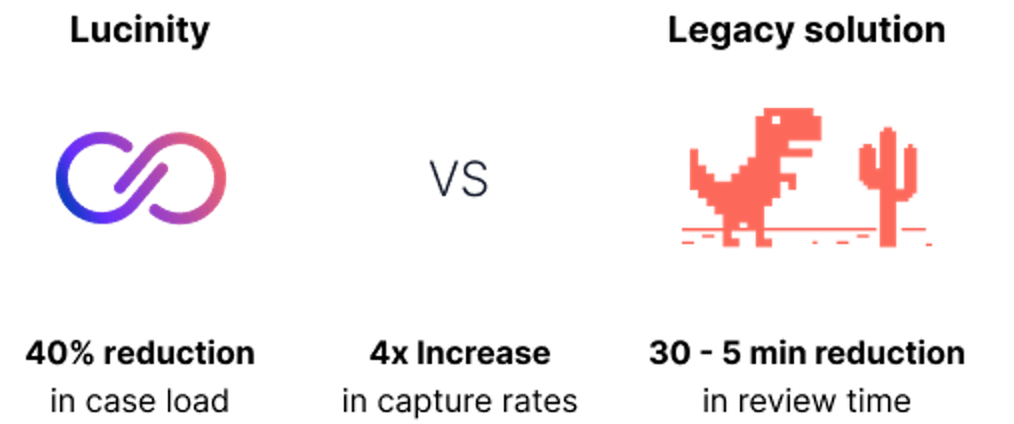

Reduce your case load by up to 50% while increasing capture rates through behavior detection.

Find more

Find more by using the power of behavior-based detection, centered around customers and peer groups instead of transactions.

Spend less

Spend less by not wasting your time making sense of data. Human AI allows you to focus on making decisions.

Continuously learn

Continuously learn with every single case through the feedback gathered from you and fed into the detection models.

Benefits at a glance

Customer-based detection

Understand your customers’ behavior.

Technology has made it possible to find more suspicious behavior while spending less resources.

Monitor your customers’ activity through their transaction network and compare their actions to past behavior and peer group activity, ensuring a leading position in compliance.

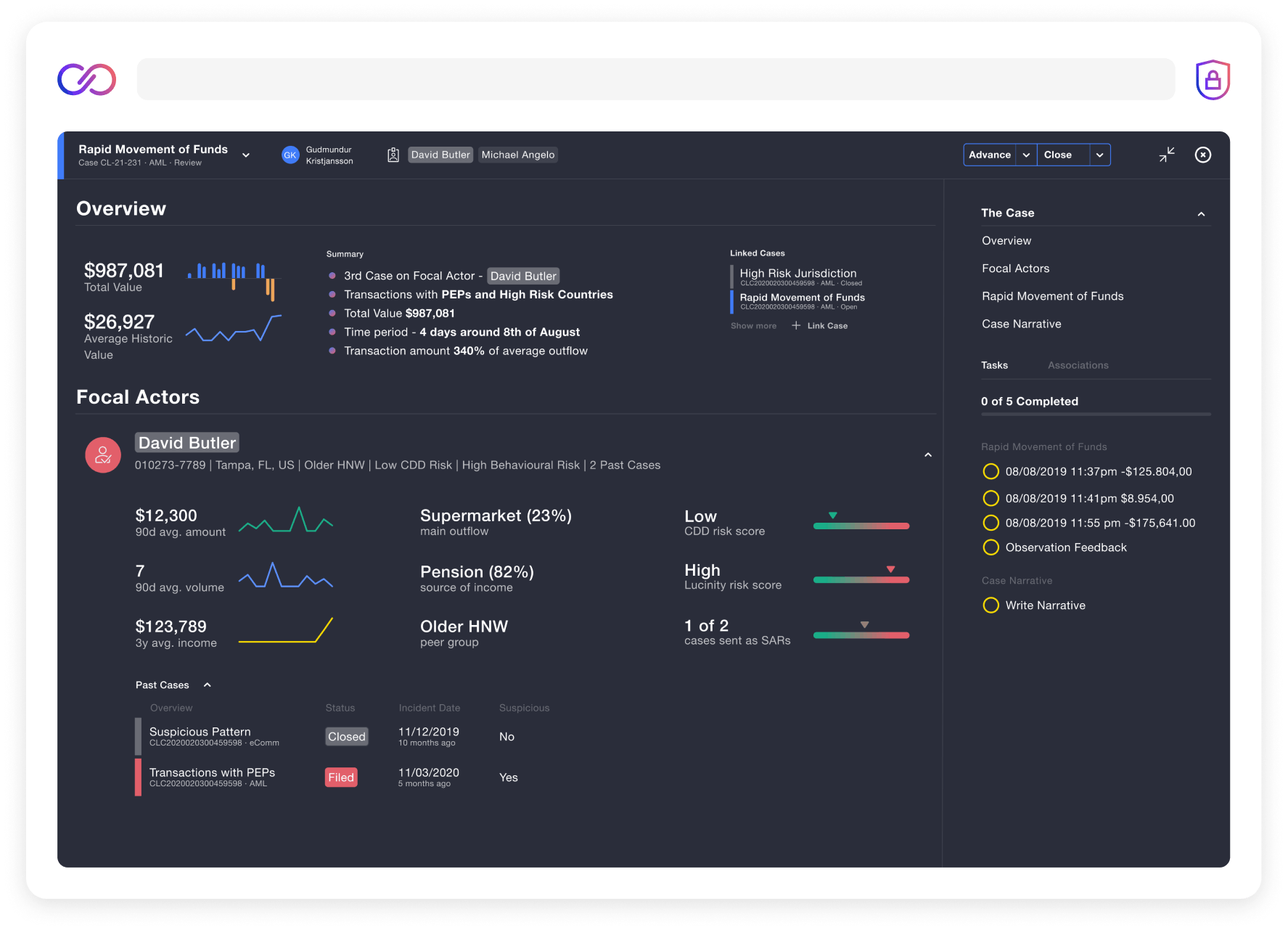

Focus on the behavior, not the transactions

We generate cases automatically based on our behavior detection engine, relieving your team from tedious and repetitive work.

Unlike most legacy systems, the cases are centered around the customer, not transactions, and are based on transaction activity, network connections, and peer-group comparisons.

AI detection at your service

Applying the relevant detection technique is crucial to an effective AML program. We tailor the method to each behavior.

Lucinity’s detection engine is a data science powerhouse that uses everything from simple rules to statistical models, self-supervised, unsupervised, and supervised Machine Learning techniques.

Complete control of your AML program

We are constantly trying to make your life easier with pre-processing, model suggestions, and more.

But we understand the importance of control and oversight and prioritize your understanding and configurability in all our products.

Increased productivity

Find more suspicious behavior from fewer cases - slashing the false positive rate.

Traditionally, AML providers force compliance professionals to choose between coverage and efficiency. Lowering thresholds to capture a few outliers introduces mountains of false positives. Utilize the most relevant detection method for each money laundering behavior and boost your productivity.

Apply deep learning, statistics, and rules

We don’t use technology for technology’s sake. Lucinity ensures the most appropriate detection method depending on the money laundering behavior in question. We work hand-in-hand with our customers to configure the optimal detection process.

Ready from the get-go

No need to label the data or spend hours on manual work to get started with Lucinity’s detection engine. Our platform is built to be ready to get you up and running in record time.

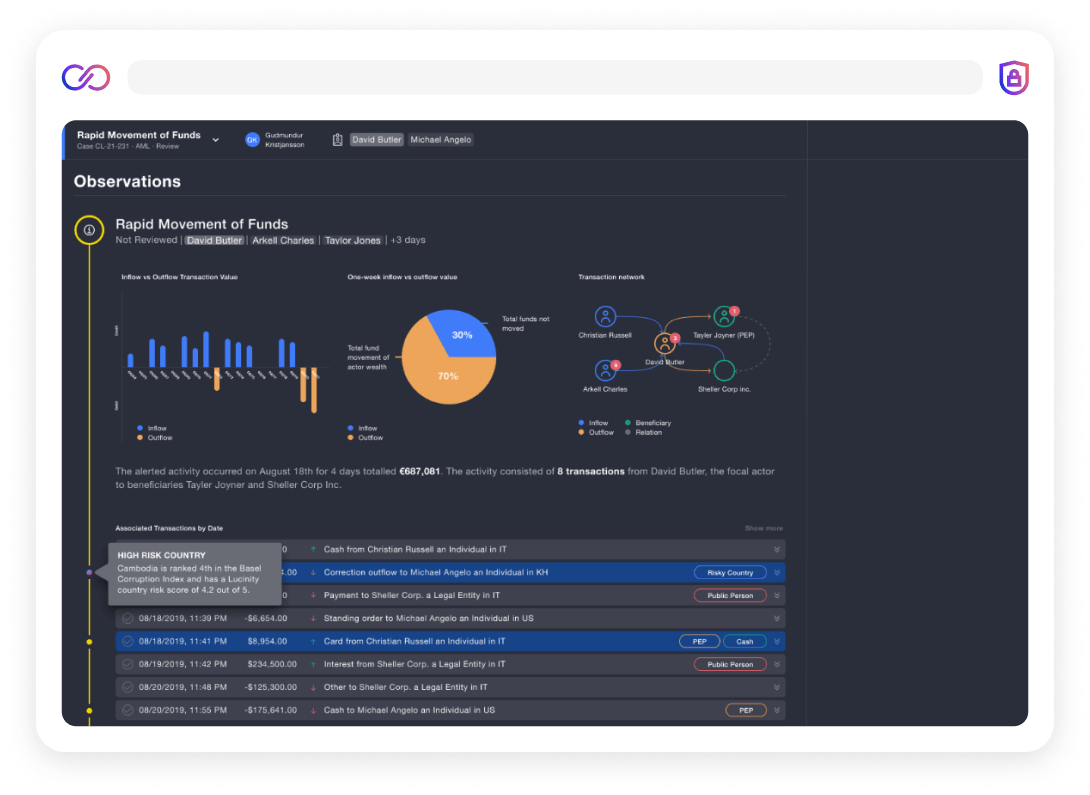

The AI black box explained

Understand and collaborate with your AI.

A key ingredient in our secret sauce is our ability to explain complex findings and translate them into understandable and actionable information. You don’t need a data science degree to reap the benefits of deep technology with Lucinity.

Organizing our behavior models into the Lucinity Knowledge Graph allows you to trace every case back to the relevant regulation. It is truly the backbone of our Human AI technology.

Easily explain your findings to regulators and foster feelings of trust and confidence within your team for quick and accurate decision making.

Always-on regulatory coverage

We have mapped out every relevant regulation into the Knowledge Graph, giving you a head-start on the competition when refining your compliance program.

Meet your regulatory requirements with our behavior detection engine. The behaviors are continually updated to ensure compliance with the latest regulations.

Continuous learning with Human AI

Finally, an AML system that automatically improves over time.

At Lucinity, we believe that to Make Money Good we must work hand-in-hand with AI. Lucinity’s solutions continuously learn through a feedback loop embedded into the system.

By capturing feedback from the system users and pushing it back into the models, we can ensure that we are constantly optimizing detection for your organization and perfecting the way information is contextually presented.

Security and compliance is in our DNA

We come from top-tier banks and international regulators, so we take our tech very seriously.

Security is at the heart of the culture at Lucinity, and this is reflected in the hiring process, employee onboarding, training, and company events.

- Lucinity’s customers are always the owners of their data. At any time, customers can request a report on data processing or request their full data set to be delivered to them.

- With the Secure Lockbox, we remove and encrypt all personally identifiable information from your customers. Thus you can rest assured your data is secure within the Lucinity cloud.

- Lucinity’s system for storing, decrypting, and transmitting PII runs in the Lucinity Secure Lockbox hosted on an isolated infrastructure and doesn’t share any credentials with Lucinity’s primary services.

- Our customers have varying regulatory compliance needs depending on region, size, and financial activities. We are ISO 27001 certified and SOC 2 compliant.