The real meaning of KYC

There's more to KYC than checkboxes

Know Your Customers for who they are

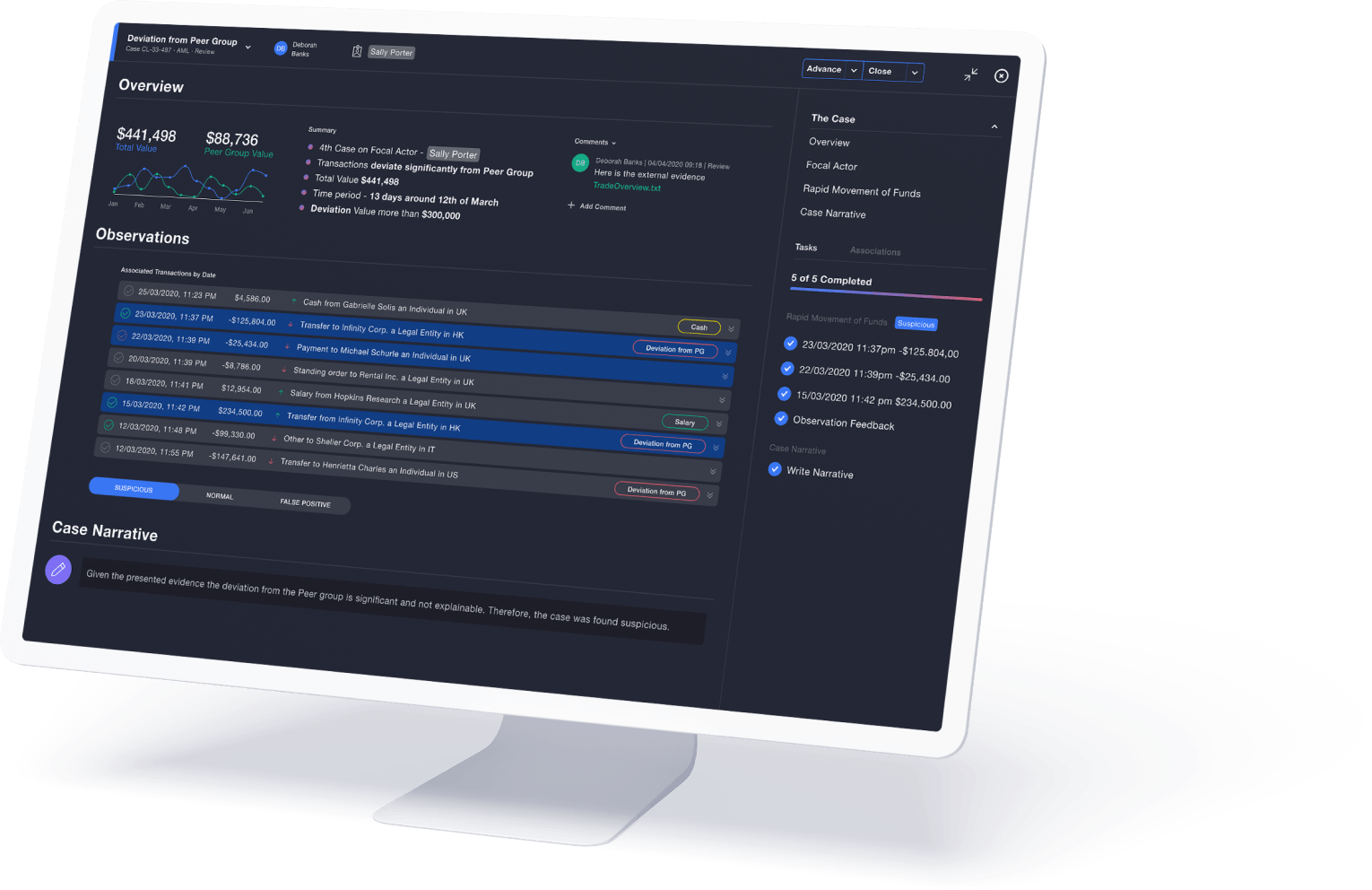

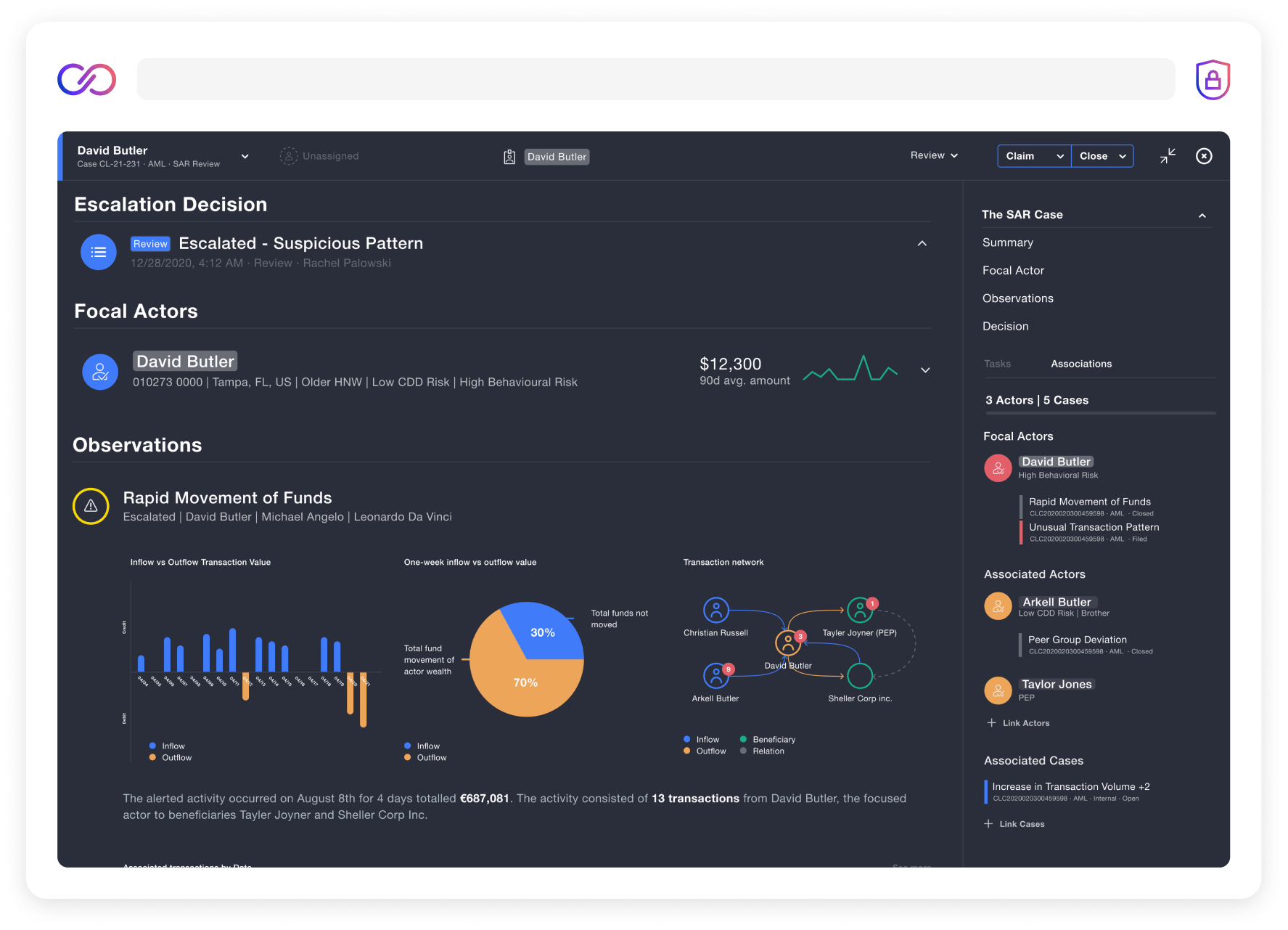

Go beyond the forms, and explore the hidden potential of your KYC data to get more value for AML. Lucinity's behavioral analysis empowers KYC to transform from periodic snapshots into real-time, continuous risk scoring. With a transparent AI at your side, you can use multidimensional AML risk scoring based on data points like your KYC touch points, transaction behavior, and reputation and turn your workload around from data processing to applying insight to AML investigations.

Lucinity uses augments the intelligence of AML analysts, and offers continuous insight into anti-money laundering best practices to help you get even better.

Sign up for our anti-money laundering insights

Make Money Good

Lucinity's recipe for anti-money laundering

Transaction monitoring

Using augmented intelligence, we are revolutionizing how financial institutions approach, understand, and deal with the ever-evolving threat of money laundering.